Startups financing options pave the way for entrepreneurial success, showcasing the diverse paths to funding and growth. Dive into a world where creativity meets capital, shaping the future of innovative ventures.

Exploring various financing avenues is crucial for startups aiming to thrive in a competitive landscape. From bootstrapping to venture capital, each option offers unique opportunities and challenges.

Importance of financing for startups

Startups require financing to fuel their growth and success. Whether it’s for developing a product, expanding operations, or entering new markets, funding is essential for startups to thrive in a competitive business environment.

Success Stories of Startups with Various Financing Options, Startups financing options

- Uber: Uber initially received funding from angel investors and venture capitalists before securing massive rounds of funding to scale globally. This enabled them to disrupt the traditional taxi industry and become a household name in the transportation sector.

- Airbnb: Airbnb raised multiple rounds of funding from investors to expand its platform and reach a global audience. This allowed them to revolutionize the hospitality industry and offer unique accommodation options worldwide.

Risks of Inadequate Financing for Startups

Insufficient funding can pose significant risks to startups, hindering their ability to achieve key milestones and sustain operations. Some of the risks associated with inadequate financing include:

- Stunted Growth: Without adequate funding, startups may struggle to scale their business, limiting their potential for expansion and market reach.

- Lack of Resources: Insufficient funds can result in a lack of resources such as skilled personnel, technology, and marketing capabilities, impacting the startup’s competitiveness.

- Cash Flow Problems: Inadequate financing may lead to cash flow issues, making it challenging for startups to meet expenses and invest in growth opportunities.

Types of financing options for startups

When it comes to financing options for startups, there are several avenues to explore. Each option comes with its own set of criteria and requirements, making it essential for startups to understand the differences between them to make an informed decision.

Bootstrapping

Bootstrapping is a financing option where startups rely on their own savings or revenue to fund their operations. This approach allows startups to maintain full control over their business without having to give up equity to external investors. However, it can be challenging for startups with limited resources to sustain growth without external funding.

Angel Investors

Angel investors are individuals who provide capital to startups in exchange for equity ownership. These investors often bring valuable expertise and connections to the table, in addition to funding. Startups looking to secure funding from angel investors typically need to have a compelling business idea, a strong team, and a scalable business model.

Venture Capital

Venture capital firms invest in startups with high growth potential in exchange for equity. These firms typically look for startups with a proven track record, a large market opportunity, and a competitive advantage. Venture capital funding can help startups scale quickly, but it also comes with the pressure to deliver significant returns to investors.

Crowdfunding

Crowdfunding allows startups to raise funds from a large number of individual investors through online platforms. This option is ideal for startups looking to validate their ideas, build a community around their brand, and access capital without giving up equity. Crowdfunding campaigns require startups to have a compelling story, clear goals, and a strong marketing strategy to attract backers.

Pros and cons of different financing methods: Startups Financing Options

When it comes to financing options for startups, each method comes with its own set of advantages and disadvantages that can significantly impact the business in the long run. Let’s take a closer look at the pros and cons of bootstrapping, angel investors, venture capital, and crowdfunding.

Bootstrapping

Bootstrapping, or self-funding, involves using personal savings, credit cards, or revenue generated by the business to fund its operations.

- Advantages:

- Full control over the business without external interference.

- No equity dilution or debt accumulation.

- Fosters a culture of frugality and resourcefulness.

- Disadvantages:

- Limited access to capital for growth and expansion.

- Risk of running out of funds before achieving profitability.

- Slower growth compared to funded startups.

Angel Investors

Angel investors are affluent individuals who provide capital in exchange for ownership equity or convertible debt.

- Advantages:

- Quick access to capital without the need for collateral.

- Mentorship and industry connections from experienced investors.

- Potential for strategic guidance and expertise.

- Disadvantages:

- Loss of ownership and decision-making control.

- Potential conflicts with investors over business strategy.

- Pressure to meet investor expectations for returns.

Venture Capital

Venture capital involves investment from firms or funds in exchange for equity, often in high-growth potential startups.

- Advantages:

- Larger funding amounts for rapid scaling and market penetration.

- Access to valuable networks and resources for growth.

- Expertise in scaling businesses for success.

- Disadvantages:

- Significant equity dilution and loss of control.

- High pressure to achieve aggressive growth targets.

- Strict reporting requirements and investor oversight.

Crowdfunding

Crowdfunding involves raising small amounts of capital from a large number of individuals through online platforms.

- Advantages:

- Access to capital from a broad investor base.

- Market validation and early customer engagement.

- Potential for building a loyal community of supporters.

- Disadvantages:

- Time-consuming campaign creation and management.

- Risk of not reaching funding goals and receiving no funds.

- Lack of investor expertise and guidance.

Strategies for choosing the right financing option

When it comes to choosing the right financing option for your startup, it’s essential to have a clear decision-making framework in place. This framework will help you evaluate and select the most suitable financing option that aligns with your startup’s growth stage and long-term goals. Additionally, preparing yourself to attract potential investors or secure loans is crucial for the success of your funding strategy.

Developing a Decision-Making Framework

- Assess your startup’s current financial situation and funding needs.

- Understand the different financing options available and their pros and cons.

- Consider the impact of each financing option on your startup’s ownership and control.

- Evaluate the risks associated with each financing method and how they align with your risk tolerance.

Tips for Attracting Investors or Securing Loans

- Prepare a solid business plan that Artikels your startup’s vision, market opportunity, and financial projections.

- Build a strong network of contacts within the industry to connect with potential investors or lenders.

- Showcase your startup’s unique value proposition and competitive advantage to attract interest from investors.

- Be transparent and open about your startup’s financials and growth potential to build trust with potential investors or lenders.

Aligning Financing Strategy with Growth Stage and Long-Term Goals

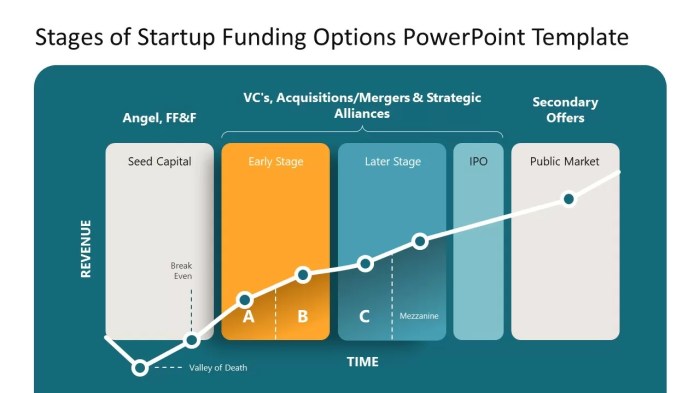

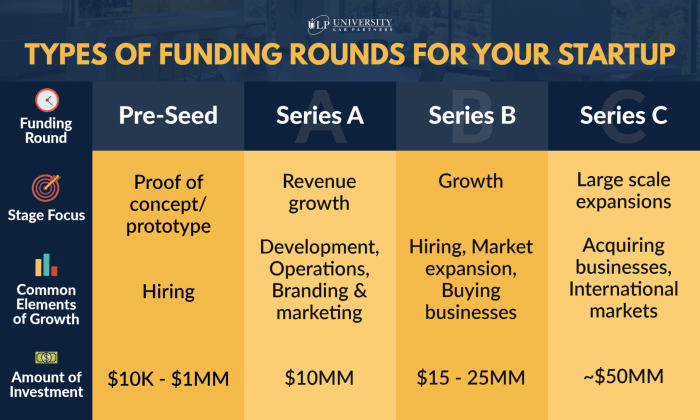

- Consider the growth stage of your startup (early-stage, growth stage, or mature stage) when choosing a financing option.

- Align your financing strategy with your long-term goals, whether it’s rapid expansion, sustainable growth, or profitability.

- Choose a financing option that not only meets your current funding needs but also supports your future growth plans.

- Regularly review and adjust your financing strategy as your startup evolves and reaches new milestones.

End of Discussion

In the realm of startups financing options, strategic decisions can make or break a business. By understanding the nuances of funding sources, entrepreneurs can chart a course towards sustainable growth and prosperity.

When you find yourself in a situation that requires legal assistance for a road traffic injury, it’s crucial to seek the expertise of a road traffic injury lawyer who can guide you through the complexities of the legal process.

Dealing with the aftermath of a truck crash can be overwhelming, but having a knowledgeable truck crash attorney on your side can make all the difference in ensuring you receive the compensation you deserve.