Startup loan interest rates play a crucial role in the borrowing process for new businesses, affecting costs and feasibility. Let’s delve into the complexities and nuances of these rates to empower entrepreneurs seeking financial support.

From defining these rates to exploring strategies for securing better terms, this comprehensive guide aims to equip you with the knowledge needed to make informed decisions for your startup venture.

Understanding Startup Loan Interest Rates

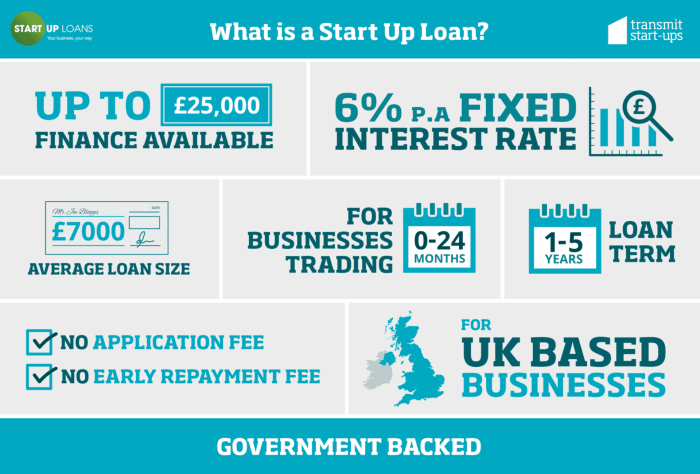

Startup loan interest rates refer to the percentage charged by a lender on the amount borrowed for a new business venture. It is crucial to comprehend how these rates are determined and their significance before securing a startup loan.

When you are in need of legal assistance due to a bicycle accident, it’s crucial to find the right Bicycle crash lawyer who can help you navigate through the complexities of personal injury law.

How Interest Rates are Determined

Interest rates for startup loans are typically based on several factors such as the borrower’s credit history, the amount borrowed, the length of the loan term, and the overall risk associated with the business venture. Lenders assess these variables to determine the level of risk involved in lending to a startup and adjust the interest rate accordingly. Additionally, market conditions and the lender’s policies also influence the final interest rate offered to the borrower.

If you are looking for the best personal injury lawyer to represent you in your case, look no further than the Best personal injury lawyer who has a proven track record of success in handling similar cases.

Importance of Understanding Interest Rates

- Understanding the interest rates associated with a startup loan enables entrepreneurs to calculate the total cost of borrowing and plan their finances effectively.

- Higher interest rates can significantly increase the overall repayment amount, impacting the business’s cash flow and profitability in the long run.

- Comparing interest rates from different lenders helps in identifying the most cost-effective financing option for the startup, saving money on interest payments.

- Awareness of interest rates empowers entrepreneurs to negotiate better terms with lenders and choose a loan structure that aligns with the business’s financial goals.

- Misunderstanding or overlooking interest rates can lead to financial strain, missed payments, and potential default on the loan, jeopardizing the startup’s success.

Types of Interest Rates for Startup Loans: Startup Loan Interest Rates

When it comes to startup loans, there are different types of interest rates that lenders may offer. Understanding these variations can help entrepreneurs make informed decisions about borrowing for their businesses.

Fixed Interest Rates vs. Variable Interest Rates

Fixed interest rates remain the same throughout the life of the loan, providing predictability for budgeting purposes. On the other hand, variable interest rates can fluctuate based on market conditions, potentially leading to lower initial rates but also higher costs in the long run.

- Fixed Interest Rates:

- Provide stability and predictability in monthly payments.

- Can be higher initially compared to variable rates.

- Offer protection against interest rate hikes.

- Variable Interest Rates:

- May start lower than fixed rates, potentially saving money in the short term.

- Can increase over time, leading to higher overall costs.

- Exposed to market fluctuations, impacting monthly payments.

Impact of Interest Rates on Borrowing Costs, Startup loan interest rates

The choice between fixed and variable interest rates can significantly impact the overall cost of borrowing for startups. While fixed rates provide stability, they may be higher initially. In contrast, variable rates offer the potential for lower costs upfront but come with the risk of increasing payments in the future. Entrepreneurs should carefully consider their financial situation and risk tolerance when deciding on the type of interest rate for their startup loan.

Factors Influencing Startup Loan Interest Rates

When it comes to determining interest rates for startup loans, lenders take into account various factors that can impact the overall cost of borrowing. Understanding these key factors can help entrepreneurs make informed decisions when seeking financing for their new ventures.

Credit Score of the Borrower

A crucial factor that lenders consider when determining interest rates for startup loans is the credit score of the borrower. A higher credit score typically indicates a lower credit risk for the lender, leading to lower interest rates offered to the borrower. On the other hand, a lower credit score may result in higher interest rates as it signals a higher risk of default.

Role of Collateral

Collateral plays a significant role in influencing interest rates for startup loans. Providing collateral, such as real estate or valuable assets, can help mitigate the lender’s risk and result in lower interest rates. Lenders are more likely to offer competitive interest rates when borrowers offer collateral that can be used to secure the loan. On the flip side, startups without collateral may face higher interest rates due to the increased risk perceived by the lender.

Tips for Getting Lower Interest Rates on Startup Loans

When looking to secure a startup loan, getting a lower interest rate can significantly impact the overall cost of borrowing. Here are some tips to help you secure lower interest rates on your startup loan:

Improve Credit Scores

One of the most effective ways to secure lower interest rates on startup loans is to improve your credit score. Lenders often use credit scores to determine the risk associated with lending money. A higher credit score demonstrates financial responsibility and can help you negotiate for lower interest rates.

Importance of a Solid Business Plan

Having a solid business plan is crucial when negotiating favorable interest rates on startup loans. A well-thought-out business plan demonstrates to lenders that you have a clear vision for your business and a strategic approach to achieving success. This can instill confidence in lenders and potentially help you qualify for lower interest rates.

Qualifying for Lower Interest Rates

- Shop Around: Compare rates from different lenders to find the best offer.

- Collateral: Offering collateral can reduce the risk for lenders, potentially leading to lower interest rates.

- Build Relationships: Establishing a relationship with a lender can increase your chances of qualifying for lower rates.

- Strong Financials: Maintaining strong financial records and demonstrating a healthy cash flow can make you a more attractive borrower.

Wrap-Up

In conclusion, understanding the intricacies of startup loan interest rates is key to navigating the financial landscape effectively. By implementing the tips provided and being mindful of the factors influencing these rates, entrepreneurs can position their startups for success in the competitive market.