Startup loan application process: A Comprehensive Guide invites readers into the world of obtaining startup loans, offering valuable insights and practical tips for navigating the application process with ease.

From understanding the steps involved to researching loan options and preparing a strong application, this guide covers everything startups need to know to secure funding for their ventures.

Understanding the Startup Loan Application Process

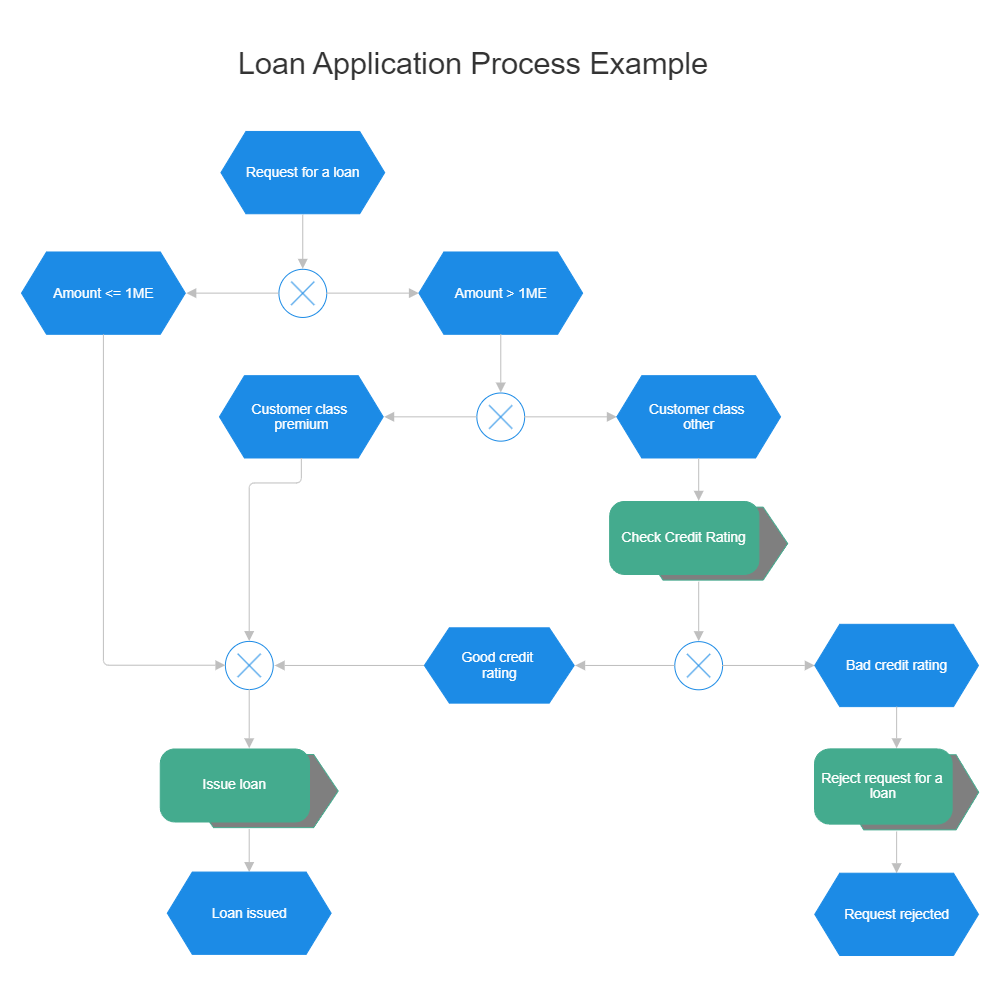

When applying for a startup loan, there are several key steps that entrepreneurs need to follow to increase their chances of securing funding for their business venture.

Key Steps in Applying for a Startup Loan, Startup loan application process

- Research Lenders: Start by researching different lenders and understanding their loan offerings, interest rates, and eligibility criteria.

- Prepare a Business Plan: Develop a detailed business plan outlining your business idea, target market, financial projections, and how the loan will be used.

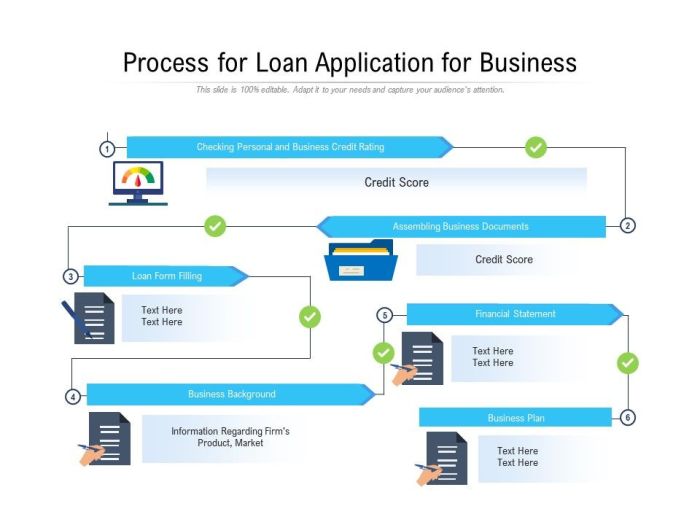

- Gather Required Documentation: Be prepared to provide documents such as personal identification, bank statements, tax returns, and financial statements.

- Submit Application: Complete the loan application form provided by the lender and submit it along with the required documentation.

- Wait for Approval: Once the application is submitted, lenders will review the information provided and make a decision on whether to approve the loan.

- Receive Funds: If approved, the funds will be disbursed to your business account, allowing you to start or grow your startup.

Key Information and Documentation Required

- Personal Identification: Driver’s license, passport, or any other government-issued ID.

- Business Plan: Detailed plan outlining your business idea, target market, and financial projections.

- Financial Statements: Bank statements, tax returns, and any other financial documentation.

- Collateral: Some lenders may require collateral to secure the loan.

Eligibility Criteria for Startup Loans

- Credit Score: A good credit score is usually required to qualify for a startup loan.

- Business Viability: Lenders will assess the viability of your business idea and its potential for success.

- Collateral: Some lenders may require collateral to secure the loan.

- Personal Investment: Showing a personal investment in the business can increase your chances of approval.

Researching Loan Options

When considering startup loan options, it is essential to research and compare the different types available in the market. Each loan option comes with its own set of advantages and disadvantages, so it’s crucial to understand which one aligns best with your business needs and financial situation.

Types of Startup Loans

- Traditional Bank Loans:

- Advantages:

- Low-interest rates

- Established reputation of banks

- Disadvantages:

- Stringent eligibility criteria

- Lengthy approval process

- Advantages:

- Online Lenders:

- Advantages:

- Quick approval process

- Less strict eligibility requirements

- Disadvantages:

- Higher interest rates

- Less established reputation compared to banks

- Advantages:

- Microloans:

- Advantages:

- Designed for small businesses

- Accessible to entrepreneurs with limited credit history

- Disadvantages:

- Smaller loan amounts

- Higher interest rates

- Advantages:

Preparing the Loan Application

When applying for a startup loan, it is crucial to have a strong business plan in place to support your application. A well-defined financial forecast is also essential in showcasing to lenders that you have a clear understanding of your business’s financial needs and projections.

Creating a Strong Business Plan

Startups can create a strong business plan by outlining their business concept, target market, competitive analysis, marketing strategy, and financial projections. It is important to provide detailed information about your products or services, target customers, and how you plan to generate revenue.

In cases where passengers are injured in an accident, consulting with a passenger injury lawyer is essential. These attorneys have the expertise to help passengers understand their rights and pursue proper compensation for their injuries.

Importance of Financial Forecast

A well-defined financial forecast demonstrates to lenders that you have a clear understanding of your startup’s financial needs and growth potential. It should include projected income statements, balance sheets, and cash flow statements to show how you will use the loan funds and repay the loan.

When involved in a car accident due to distracted driving, seeking the help of a distracted driving accident attorney is crucial. These specialized lawyers can assist in navigating the legal process and ensuring you receive the compensation you deserve.

Improving Credit Score

To increase your chances of loan approval, startups can improve their credit score by paying bills on time, reducing debt, and monitoring their credit report for any errors. It is also helpful to keep credit utilization low and avoid opening multiple new credit accounts before applying for a loan.

Submitting the Application and Approval Process: Startup Loan Application Process

Once the startup loan application is completed and all necessary documents are gathered, it is time to submit the application for review and approval.

Submission Process

Startups can typically submit their loan applications online through the lender’s website or in-person at a physical branch. The application will require detailed information about the business, its financials, and the purpose of the loan.

Approval Timeline and Fund Disbursement

- After submitting the application, startups can expect to receive a decision within a few weeks. The timeline may vary depending on the lender and the complexity of the application.

- If the loan is approved, the funds are typically disbursed shortly after the approval decision. Startups should have a clear plan in place for the use of the funds once they are received.

Expectations and Challenges

- During the loan approval process, startups can expect to be contacted by the lender for additional information or clarification on certain aspects of the application.

- Challenges that startups may face during the approval process include a lengthy review period, strict eligibility criteria, and the need for a solid business plan to demonstrate the viability of the startup.

Conclusion

In conclusion, the Startup loan application process: A Comprehensive Guide equips startups with the knowledge and tools needed to successfully apply for and secure the funding they need to bring their business ideas to life.