Startup line of credit offers a lifeline to new businesses looking for flexible financing options. This essential guide explores the ins and outs of securing and utilizing a startup line of credit, shedding light on key aspects crucial for entrepreneurial success.

From qualifications to managing funds, uncover everything you need to know about this invaluable resource for startup growth.

Overview of Startup Line of Credit

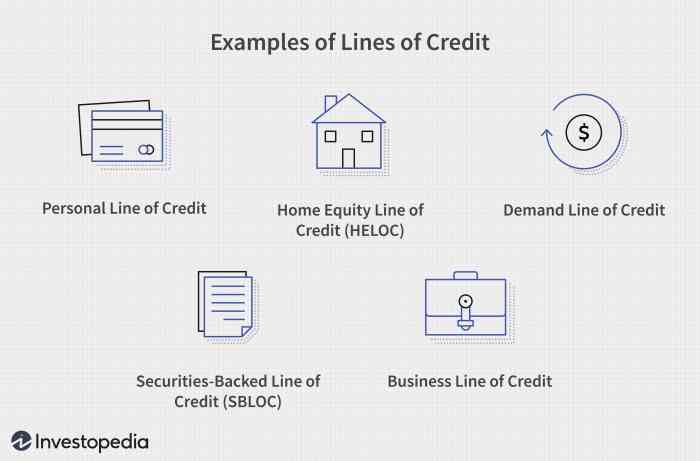

A startup line of credit is a financial tool that provides new businesses with access to a revolving credit line to help manage cash flow, cover operational expenses, and fund growth initiatives.

Typically, a startup line of credit offers flexibility in borrowing and repayment, allowing entrepreneurs to draw funds as needed and only pay interest on the amount utilized. This type of financing is particularly useful for startups with fluctuating cash flow or seasonal sales cycles.

In the unfortunate event of a head-on crash, it is essential to consult with a head-on crash lawyer who can provide you with the necessary legal guidance and representation. These lawyers are well-versed in the laws surrounding head-on collisions and can help you pursue the compensation you deserve.

Features and Benefits of Startup Line of Credit

- Flexible borrowing: Entrepreneurs can access funds on an as-needed basis, up to a predetermined credit limit.

- Revolving credit: Repaid amounts become available for borrowing again, providing ongoing access to capital.

- Interest-only payments: Businesses only pay interest on the amount borrowed, potentially reducing overall borrowing costs.

- Build credit history: Managing a line of credit responsibly can help establish a positive credit profile for the business.

- Funding flexibility: Can be used for various business purposes, such as inventory purchases, equipment upgrades, or marketing campaigns.

Differences from Other Business Financing Options

A startup line of credit differs from traditional term loans in that it offers greater flexibility in borrowing and repayment. While term loans provide a lump sum of capital upfront with fixed monthly payments, a line of credit allows for ongoing access to funds with variable repayment terms.

Additionally, unlike business credit cards that may have higher interest rates, a startup line of credit typically offers lower rates and higher credit limits, making it a cost-effective financing solution for startups.

Qualifications and Eligibility

Startup line of credit offers a valuable financial resource for new businesses, but qualifying for this credit facility may require meeting specific criteria.

Typical Requirements for Qualifying

- Business Plan: Lenders often require a detailed business plan outlining the startup’s goals, market analysis, and financial projections.

- Credit Score: A good personal credit score, typically above 680, is often necessary to secure a startup line of credit.

- Collateral: Some lenders may require collateral, such as business assets or personal guarantees, to mitigate the risk.

- Business Age: While some lenders work with very early-stage startups, others may prefer businesses with a proven track record of at least six months to a year.

- Revenue: Startups with consistent revenue streams are more likely to qualify for a line of credit, as it demonstrates the ability to repay the borrowed funds.

Application Process

When applying for a startup line of credit, there are specific steps involved to ensure a smooth and efficient process. The application process typically requires certain documentation to be submitted for evaluation. Let’s explore the details below.

Steps Involved

- Research Lenders: Start by researching different lenders offering startup lines of credit to find the best fit for your business needs.

- Prepare Documentation: Gather necessary documents such as business plan, financial statements, personal credit history, and any other relevant information.

- Submit Application: Fill out the application form provided by the lender and submit it along with the required documentation.

- Review Process: The lender will review your application, conduct a credit check, and assess your business’s financial health.

- Approval and Terms: If approved, you will receive the terms of the line of credit including the amount, interest rate, and repayment terms.

- Utilize Funds: Once approved, you can start using the line of credit for your business expenses.

Documentation Required

- Business Plan outlining your business model, target market, and financial projections.

- Financial Statements including income statements, balance sheets, and cash flow projections.

- Personal Credit History to assess your creditworthiness as a business owner.

- Collateral may be required depending on the lender’s terms and your credit profile.

- Legal Documents such as business licenses, registrations, and any relevant contracts.

Comparison with Other Financing

- Startup Line of Credit vs. Business Loans: A line of credit provides flexibility with ongoing access to funds, while a loan offers a lump sum amount with fixed repayment terms.

- Startup Line of Credit vs. Credit Cards: Lines of credit typically have lower interest rates and higher credit limits compared to credit cards.

- Startup Line of Credit vs. Equity Financing: With a line of credit, you retain ownership of your business without diluting equity as with equity financing.

Managing and Using a Startup Line of Credit

Effectively managing a startup line of credit is crucial for the financial health and success of your business. Responsible borrowing and avoiding common mistakes are key factors to consider when utilizing a line of credit.

Strategies for Effective Management

- Regularly monitor your credit line usage and stay within your approved limit to avoid overextending your finances.

- Create a detailed repayment plan to ensure timely payments and avoid accumulating unnecessary interest charges.

- Use the line of credit for short-term needs or emergencies, rather than relying on it for long-term financing.

- Seek advice from financial professionals or advisors to help you make informed decisions about using the line of credit.

Importance of Responsible Borrowing

Responsible borrowing involves using the line of credit wisely and only for necessary expenses that will contribute to the growth of your business. It is essential to consider the impact of borrowing on your cash flow and overall financial stability.

When facing legal issues related to a drunk driving accident, it is crucial to seek the help of a drunk driving accident lawyer who specializes in handling such cases. These lawyers have the expertise and experience to navigate through the complexities of the legal system and ensure that your rights are protected.

Common Mistakes to Avoid

- Avoid using the line of credit for personal expenses or non-business-related purchases.

- Do not borrow more than your business can realistically repay, as this can lead to financial strain and potential default.

- Avoid missing payments or making late payments, as this can negatively impact your credit score and relationship with the lender.

- Do not rely solely on the line of credit to cover operating expenses without a clear plan for repayment.

Interest Rates and Fees

When considering a startup line of credit, it’s important to understand how interest rates are determined and the various fees associated with this type of financing.

Interest Rates for Startup Line of Credit

Interest rates for a startup line of credit are typically determined based on the lender’s assessment of the borrower’s creditworthiness, the amount of credit requested, and current market conditions. Generally, the better the credit score and financial history of the borrower, the lower the interest rate offered.

Fees Associated with Startup Line of Credit

- Origination fees: These are one-time fees charged by the lender for processing the line of credit.

- Maintenance fees: Some lenders may charge a periodic fee for keeping the line of credit open.

- Draw fees: A fee may be charged each time the borrower accesses funds from the line of credit.

- Early repayment fees: If the borrower pays off the line of credit before the agreed-upon term, they may incur a penalty fee.

Comparison with Other Financing Options

When comparing interest rates and fees of a startup line of credit with other financing options, it’s essential to consider the flexibility and convenience that a line of credit offers. While interest rates may be higher compared to traditional loans, the ability to access funds on an as-needed basis can make a line of credit a cost-effective option for startups with fluctuating cash flow needs.

Wrap-Up: Startup Line Of Credit

In conclusion, a startup line of credit can be a game-changer for budding entrepreneurs, providing the financial support needed to navigate the challenges of launching a new venture. By understanding the nuances of this financial tool, startups can make informed decisions to propel their growth and success.