Startup capital financing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From various financing types to success stories, this topic delves deep into the world of funding for startups.

Types of Startup Capital Financing

Startup capital financing is essential for new businesses to get off the ground and grow. There are several types of startup capital financing available, each with its own advantages and disadvantages.

Equity Financing

Equity financing involves exchanging a share of ownership in the company for capital. Investors become partial owners and share in the profits and losses of the business.

- Example: Venture capital firms invest in startups in exchange for equity.

- Advantages: No need to repay the investment, investors share the risk.

- Disadvantages: Loss of control as investors have a say in decision-making.

Debt Financing

Debt financing involves borrowing money that needs to be repaid with interest over a specific period. This can be in the form of loans or bonds.

- Example: Taking out a business loan from a bank.

- Advantages: Retain full ownership and control of the business.

- Disadvantages: Repayment with interest can strain cash flow, especially in the early stages.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. Contributors may receive perks or rewards in return.

- Example: Kickstarter campaigns where backers receive early access to products.

- Advantages: Access to a large pool of potential investors, validation of the business idea.

- Disadvantages: Time-consuming to manage campaign, may not reach funding goal.

Venture Capital Funding

Venture capital funding is a type of financing provided by investors to startups and small businesses that are deemed to have high growth potential. In exchange for the investment, venture capitalists typically receive equity in the company.

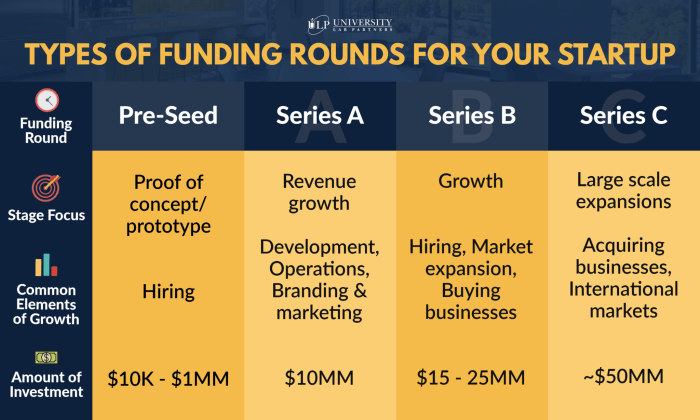

Typical Stages for Venture Capital Funding

- Seed Stage: At this initial stage, startups receive funding to conduct research and develop their business idea.

- Early Stage: Startups that have a proven concept and are ready to bring their product or service to market seek funding at this stage.

- Growth Stage: Companies that have already established a market presence and are looking to expand their operations or enter new markets seek funding at the growth stage.

Comparison with Other Forms of Startup Capital Financing

- Angel Investors: While angel investors also provide funding to startups, venture capitalists generally invest larger amounts and are more involved in the management and decision-making processes of the company.

- Bank Loans: Unlike traditional bank loans, venture capital funding does not require collateral and is typically more suitable for startups that may not have significant assets to pledge.

- Crowdfunding: Crowdfunding involves raising small amounts of money from a large number of people, whereas venture capital funding usually involves a larger investment from a single entity or a group of investors.

Angel Investors: Startup Capital Financing

Angel investors play a crucial role in startup capital financing by providing early-stage funding to promising startups in exchange for equity ownership.

Role of Angel Investors

- Angel investors typically invest their own money into startups, offering financial support when traditional funding sources may be unavailable.

- They often provide valuable mentorship, guidance, and industry connections to help startups grow and succeed.

- Angel investors take on higher risks compared to other investors but also have the potential for significant returns if the startup becomes successful.

Examples of Successful Startups

- Uber: Angel investors like Chris Sacca and Naval Ravikant provided early funding to Uber, contributing to its rapid growth and success in the ride-sharing industry.

- Facebook: Angel investor Peter Thiel was one of the first investors in Facebook, playing a key role in the social media giant’s early development.

Attracting Angel Investors

- Develop a solid business plan and pitch that clearly Artikels the startup’s value proposition, market potential, and growth strategy.

- Network within the startup and investor community to connect with potential angel investors who have an interest in your industry.

- Demonstrate traction and progress by showcasing early customer adoption, revenue growth, or product development milestones.

- Show transparency and honesty in your communication with angel investors, addressing risks and challenges while highlighting the potential for high returns.

Crowdfunding

Crowdfunding is a popular method for startups to raise capital by collecting small amounts of money from a large number of people, typically through online platforms. This allows entrepreneurs to access funding from a wide pool of investors, supporters, and potential customers.

Types of Crowdfunding Platforms, Startup capital financing

- Reward-based Crowdfunding: Backers receive rewards or products in exchange for their contributions. Platforms like Kickstarter and Indiegogo fall into this category.

- Equity Crowdfunding: Investors receive equity in the company in exchange for their funding. Examples include SeedInvest and Crowdcube.

- Debt Crowdfunding: Startups borrow money from individuals or institutions and repay with interest. Platforms like LendingClub and Funding Circle offer this type of crowdfunding.

Success Stories of Crowdfunded Startups

- Oculus Rift: The virtual reality company raised over $2.4 million on Kickstarter before being acquired by Facebook for $2 billion.

- Pebble: The smartwatch company raised over $10 million on Kickstarter, becoming one of the most successful crowdfunding campaigns at that time.

- Exploding Kittens: A card game project that raised over $8.7 million on Kickstarter, showcasing the power of crowdfunding for creative projects.

Final Wrap-Up

In conclusion, Startup capital financing is a crucial aspect for new ventures, shaping their financial future and growth potential. By exploring different funding avenues like venture capital, angel investors, and crowdfunding, startups can pave the way for success in a competitive market landscape.

When you find yourself in need of a motorcycle crash lawyer , it’s crucial to seek out a professional who understands the complexities of these types of cases. A skilled attorney can help you navigate the legal process and fight for the compensation you deserve.

If you’ve been involved in a car accident and are looking for a car crash settlement attorney , it’s important to find someone with experience in negotiating settlements. An attorney specializing in car crash settlements can help you secure the best possible outcome for your case.