Small business startup loans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. Understanding the concept, qualifying, applying, and managing these loans is crucial for aspiring entrepreneurs.

Understanding Small Business Startup Loans

Small business startup loans play a crucial role in helping aspiring entrepreneurs turn their business ideas into reality by providing the necessary financial support.

If you have been involved in a scaffolding accident, it is essential to seek the expertise of a scaffolding accident lawyer who specializes in handling such cases. They can help you navigate the complexities of the legal system and fight for the compensation you deserve.

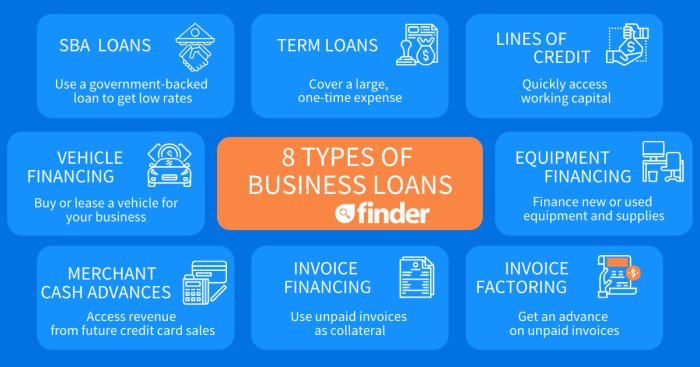

Types of Small Business Startup Loans

- Traditional Bank Loans: These loans are offered by banks and credit unions, typically requiring a good credit score and collateral.

- SBA Loans: Small Business Administration loans are government-backed loans with favorable terms and lower interest rates.

- Online Lenders: Online platforms provide quick access to funds with less stringent requirements, but often come with higher interest rates.

- Microloans: These are small loans offered by non-profit organizations to support small businesses in need of capital.

Importance of Small Business Startup Loans

Small business startup loans are essential for entrepreneurs as they provide the necessary funding to cover initial costs such as equipment, inventory, marketing, and operational expenses. Without access to these loans, many aspiring business owners would struggle to launch their ventures and achieve their goals.

Qualifying for Small Business Startup Loans

When it comes to qualifying for small business startup loans, there are certain eligibility requirements that lenders typically look for. Understanding these criteria and how they differ between traditional bank loans and alternative lenders can help small business owners improve their chances of securing the funding they need.

After an accident, seeking legal advice is crucial to protect your rights and ensure fair compensation. It is important to consult with a knowledgeable attorney who can guide you through the legal process and advocate on your behalf.

Typical Eligibility Requirements, Small business startup loans

Before applying for a small business startup loan, it is important to be aware of the typical eligibility requirements that lenders may consider:

- A solid business plan outlining your business goals, target market, financial projections, and how the loan will be used.

- A good personal credit score to demonstrate your ability to manage finances responsibly.

- Collateral to secure the loan, which can be business assets, personal assets, or a personal guarantee.

- A strong cash flow to show that your business can generate enough revenue to repay the loan.

Comparison of Criteria

Traditional bank loans and alternative lenders may have different criteria when it comes to evaluating small business startup loan applications:

| Criteria | Traditional Bank Loans | Alternative Lenders |

|---|---|---|

| Credit Score | Higher credit score requirements | May be more flexible with credit scores |

| Collateral | May require more collateral | May offer unsecured loan options |

| Processing Time | Longer processing time | Quicker approval process |

Tips for Improving Qualification Chances

Small business owners can take steps to enhance their chances of qualifying for a startup loan:

- Work on improving your personal credit score before applying for a loan.

- Create a detailed and comprehensive business plan that highlights your business’s potential for success.

- Build a strong relationship with your bank or lender to increase your chances of approval.

- Show a clear plan for how the loan funds will be used to grow your business.

Applying for Small Business Startup Loans

When it comes to applying for small business startup loans, there are several steps you need to follow to increase your chances of approval. It is important to provide the necessary documentation and avoid common mistakes that could hinder your application process.

Step-by-Step Process of Applying for a Small Business Startup Loan

- Research and Compare Lenders: Start by researching different lenders and comparing their terms and interest rates to find the best fit for your business.

- Prepare a Detailed Business Plan: Lenders will want to see a detailed business plan that Artikels your business goals, target market, financial projections, and how you plan to use the loan funds.

- Gather Required Documentation: Be prepared to provide documentation such as your personal and business credit scores, tax returns, financial statements, and legal documents.

- Submit Your Loan Application: Fill out the loan application form accurately and provide all the required documentation to the lender.

- Wait for Approval: Once you have submitted your application, wait for the lender to review your documents and make a decision on your loan application.

Documentation Needed When Applying for a Startup Loan

- Business Plan: A detailed business plan that includes information about your business, target market, competition, and financial projections.

- Personal and Business Credit Scores: Lenders will review your personal and business credit scores to assess your creditworthiness.

- Financial Statements: Prepare financial statements such as income statements, balance sheets, and cash flow statements to provide a snapshot of your business’s financial health.

- Tax Returns: Provide copies of your personal and business tax returns for the past few years to demonstrate your financial history.

Common Mistakes to Avoid During the Application Process

- Not Having a Solid Business Plan: A detailed and well-thought-out business plan is essential for securing a startup loan. Make sure to include all relevant information and projections.

- Ignoring Your Credit Score: Your personal and business credit scores play a significant role in the loan approval process. Make sure to review and improve your credit scores before applying for a loan.

- Providing Incomplete Documentation: Failing to provide all the required documentation or submitting incomplete information can lead to delays or rejection of your loan application.

- Applying for the Wrong Type of Loan: Make sure to research and apply for a loan that aligns with your business needs. Applying for the wrong type of loan can lead to unfavorable terms or rejection.

Managing Small Business Startup Loans

Effective management and repayment of small business startup loans are crucial for the financial health and success of your business. Here are some strategies to help you navigate this process:

Creating a Realistic Repayment Plan

- Assess your cash flow and financial projections to determine a feasible repayment schedule.

- Consider making more frequent, smaller payments to reduce the overall interest paid.

- Communicate with your lender if you anticipate any challenges in meeting the repayment schedule.

Monitoring Expenses Closely

- Track your business expenses diligently to ensure that funds are used efficiently and effectively.

- Avoid unnecessary spending and prioritize loan repayment to minimize financial strain.

- Seek ways to streamline operations and reduce costs to free up funds for loan repayment.

Building a Strong Credit History

- Make timely payments on all your financial obligations to maintain a positive credit score.

- A good credit history can help you negotiate better loan terms and rates in the future.

- Monitor your credit report regularly and address any discrepancies promptly to safeguard your creditworthiness.

Exploring Refinancing Options

- Consider refinancing your startup loan if you can secure better terms or lower interest rates.

- Shop around for competitive offers from different lenders to find the most favorable refinancing option.

- Ensure that the benefits of refinancing outweigh the costs and potential drawbacks before making a decision.

Understanding the Implications of Default

- Defaulting on a small business startup loan can damage your credit score and financial reputation.

- Lenders may pursue legal action to recover the outstanding debt, leading to potential business closure or bankruptcy.

- Seek professional advice and explore alternative solutions if you are at risk of defaulting on your loan.

Ending Remarks

In conclusion, Small business startup loans are a vital resource for entrepreneurs embarking on their business journey. By delving into the details of eligibility, application, and management, individuals can make informed decisions and pave the way for their business success.