Small business startup funds are crucial for new ventures to thrive. From understanding the concept to securing funding, this comprehensive guide covers everything you need to know.

Whether you’re exploring traditional financing options or considering alternative sources like crowdfunding, this guide will help you navigate the complex landscape of startup funding.

Understanding Small Business Startup Funds

Starting a small business requires adequate startup funds to cover initial expenses and investments. These funds are crucial for getting the business off the ground and ensuring its smooth operation in the early stages.

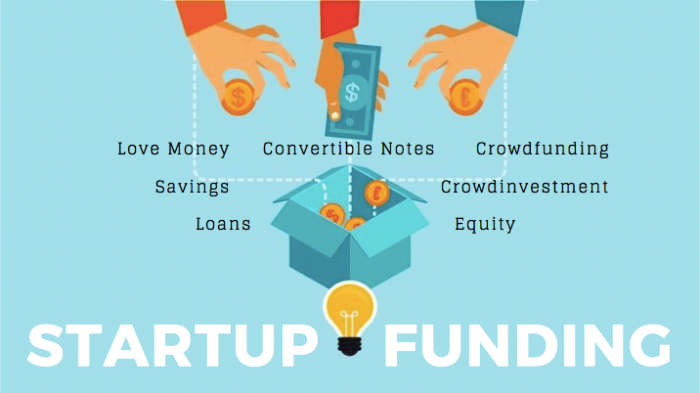

Sources of Startup Funds

- Personal Savings: Many entrepreneurs use their own savings to fund their small business startup. This provides full control over the funds and avoids taking on debt.

- Loans: Small business owners can apply for loans from banks, credit unions, or online lenders to secure the necessary funds. These loans can be in the form of traditional term loans, lines of credit, or SBA loans.

- Investors: Some small businesses seek funding from angel investors, venture capitalists, or crowdfunding platforms. In exchange for funding, investors may receive equity in the business.

- Grants: Certain government agencies, non-profit organizations, and corporations offer grants to support small business startups. These grants do not need to be repaid but often come with specific requirements and restrictions.

Importance of Adequate Startup Funds

Having adequate startup funds is crucial for small businesses for several reasons:

- Ensures Smooth Operations: Sufficient funds enable the business to cover initial expenses, such as rent, utilities, inventory, and marketing, without facing cash flow issues.

- Supports Growth and Expansion: With adequate funds, small businesses can invest in growth opportunities, expand their product lines, reach new markets, and scale their operations.

- Provides a Safety Net: Having a financial cushion allows businesses to weather unexpected challenges, such as economic downturns, supply chain disruptions, or unforeseen expenses.

Types of Small Business Startup Funds

When it comes to funding a small business startup, there are various options available to entrepreneurs. Each type of funding comes with its own set of advantages and disadvantages, catering to different financial needs and risk preferences.

Debt Financing vs. Equity Financing

Debt financing involves borrowing money that must be repaid over time, usually with interest. This can include bank loans, credit cards, or lines of credit. On the other hand, equity financing involves selling a portion of the business in exchange for capital. This can be in the form of angel investors, venture capitalists, or crowdfunding platforms.

When you’re involved in a car accident and need legal assistance to settle your claim, it’s crucial to find a reputable car accident settlement lawyer who can represent your best interests.

Alternative Funding Options

- Crowdfunding: Platforms like Kickstarter or Indiegogo allow entrepreneurs to raise funds from a large number of individuals.

- Grants: Government agencies, non-profit organizations, and corporations offer grants to support specific business initiatives.

- Angel Investors: High-net-worth individuals who provide capital in exchange for ownership equity or convertible debt.

Bootstrapping

Bootstrapping is the process of funding a business using personal savings, revenue from sales, or operating profits. While this method allows for greater control and flexibility, it can limit the growth potential of the business due to resource constraints.

If you’ve been injured in a truck accident, seeking the expertise of a skilled truck accident injury lawyer can help you navigate the complex legal process and secure the compensation you deserve.

Creating a Budget for Startup Funds: Small Business Startup Funds

When starting a small business, it is crucial to create a detailed budget for startup funds to ensure financial stability and success in the long run.

Estimating Initial Startup Costs

Estimating initial startup costs accurately is essential for creating a realistic budget. Here are the steps involved:

- Identify all necessary expenses: Make a list of all the costs involved in starting your business, including equipment, supplies, licenses, permits, and marketing expenses.

- Research costs: Research the current market prices for the items on your list to get an accurate estimate of how much you will need to spend.

- Consider one-time and ongoing costs: Differentiate between one-time expenses and ongoing costs to better plan for your budget.

- Factor in unexpected expenses: It is important to include a buffer for unexpected costs that may arise during the startup phase.

Significance of Contingency Planning

Contingency planning plays a crucial role in budgeting for startup funds as it helps mitigate risks and uncertainties. Here’s why it is significant:

- Allows flexibility: Having a contingency plan in place allows you to adapt to unforeseen circumstances without jeopardizing your business.

- Minimizes financial risks: By setting aside funds for contingencies, you can protect your business from financial setbacks that may occur.

- Ensures long-term sustainability: Planning for unexpected expenses ensures that your business can continue to operate smoothly even in challenging times.

Securing Small Business Startup Funds

Securing funding for your small business is crucial for getting your venture off the ground and running successfully. There are various strategies and sources you can explore to secure the necessary funds.

Securing Funding from Traditional Financial Institutions

When seeking funding from traditional financial institutions like banks, it’s essential to have a solid business plan in place. Banks typically look for businesses with a clear plan for success and a strong ability to repay the loan. Be prepared to provide detailed financial projections, collateral, and a good credit history to increase your chances of securing the funds.

Pitching to Venture Capitalists or Angel Investors, Small business startup funds

Pitching to venture capitalists or angel investors requires a compelling business pitch that highlights the potential for high returns on their investment. You need to clearly articulate your business idea, target market, competitive advantage, and growth strategy. It’s crucial to demonstrate a deep understanding of your industry and market to instill confidence in potential investors.

Importance of a Solid Business Plan

A solid business plan is essential for securing startup funds from any source. It serves as a roadmap for your business and demonstrates to investors that you have a clear vision for success. A well-structured business plan should Artikel your business goals, target market, financial projections, marketing strategy, and operational plan. Investors want to see that you have thought through all aspects of your business and have a realistic plan for achieving success.

End of Discussion

In conclusion, securing adequate startup funds is a critical step towards the success of your small business. By following the strategies Artikeld in this guide, you’ll be well-equipped to fund your entrepreneurial journey and turn your business dreams into reality.