Delving into Small business funding for startups, this introduction immerses readers in a unique and compelling narrative. Explaining the significance of funding for startups, exploring various funding options available, and delving into the challenges faced during the funding search.

Overview of Small Business Funding for Startups

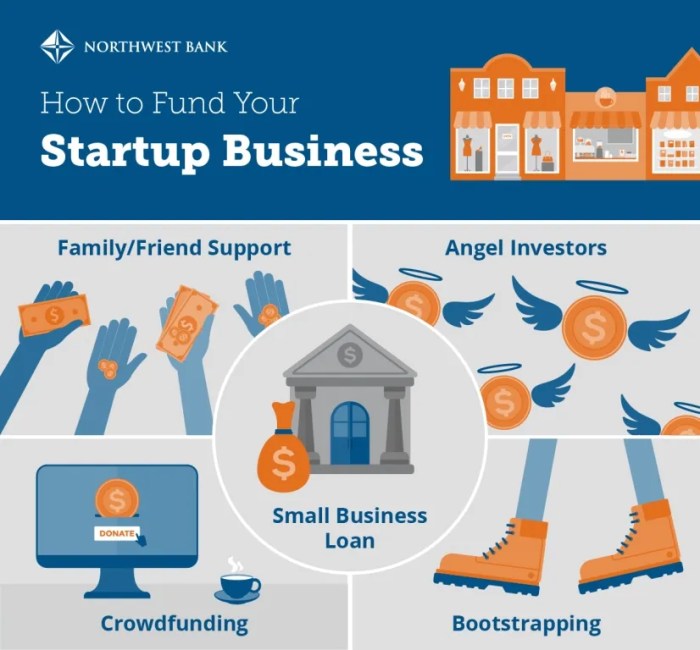

Starting a small business is an exciting venture, but one of the biggest challenges entrepreneurs face is securing the necessary funding to get their business off the ground. In this overview, we will discuss the importance of funding for startups, the various types of funding options available, and the common challenges faced by startups when seeking funding.

Importance of Funding for Startups

Securing funding is crucial for startups to cover initial costs such as product development, marketing, hiring employees, and other operational expenses. Without adequate funding, a startup may struggle to grow and compete in the market. Funding also provides startups with the resources needed to scale their business and reach their full potential.

Types of Funding Options for Small Businesses

- Personal Savings: Many entrepreneurs use their personal savings to fund their startup. This can be a quick and easy way to get started without relying on external funding sources.

- Loans: Small business loans from banks or online lenders are a common funding option. These loans provide entrepreneurs with capital that must be repaid over time with interest.

- Venture Capital: Venture capitalists invest in startups in exchange for equity. This type of funding is ideal for high-growth startups with the potential for significant returns.

- Angel Investors: Angel investors are individuals who provide funding to startups in exchange for equity or convertible debt. They often offer mentorship and industry connections in addition to capital.

Challenges Faced by Startups in Securing Funding

- Lack of Collateral: Startups often lack the assets or collateral required to secure traditional bank loans, making it difficult to access funding.

- High Risk: Investors view startups as high-risk investments due to their uncertain future and potential for failure, making it challenging to attract funding.

- Competition: The startup ecosystem is competitive, with many entrepreneurs vying for limited funding opportunities, leading to fierce competition for investment.

Bootstrapping as a Funding Method

Bootstrapping is a funding method where startups rely on personal savings, revenue generated from early sales, or other non-traditional sources to fund their business without external investors.

Examples of Successful Bootstrapped Companies

- Basecamp: The project management software company started with just $10,000 of the founders’ money and grew organically without any external funding.

- Mailchimp: The email marketing platform was bootstrapped by its founders and eventually became a successful company without taking any venture capital.

- Squarespace: The website building platform started as a side project without external funding and grew into a successful business.

Advantages and Disadvantages of Bootstrapping for Startups

Bootstrapping offers startups certain advantages such as:

- Control: Founders maintain full control over the direction and decisions of the business without outside influence.

- Flexibility: Startups can adapt quickly to market changes and pivot their business model without needing approval from investors.

- Profit Retention: All profits generated belong to the founders, allowing for reinvestment back into the business.

However, bootstrapping also comes with its own set of disadvantages:

- Limitations: Startups may face limitations in terms of resources, growth potential, and scalability without external funding.

- Risk: Founders bear all the financial risk themselves, which can be stressful and impact personal finances.

- Slow Growth: Bootstrapped startups may experience slower growth compared to those with external funding and struggle to compete in the market.

Angel Investors and Venture Capitalists

Angel investors and venture capitalists are both sources of funding for startups, but they differ in their investment approach and expectations.

Differentiation between Angel Investors and Venture Capitalists

- Angel Investors: Individual investors who provide capital for startups in exchange for ownership equity. They are usually wealthy individuals who invest their own money.

- Venture Capitalists: Professional investment firms that manage pooled funds from various sources, such as pension funds, endowments, and high-net-worth individuals. They invest in startups with high growth potential in exchange for equity.

Attracting Angel Investors or Venture Capitalists

- Networking: Building relationships with angel investor groups or venture capital firms through networking events, conferences, and introductions from industry contacts.

- Strong Pitch: Creating a compelling business plan and pitch deck that clearly articulates the startup’s value proposition, market opportunity, and growth potential.

- Proven Track Record: Demonstrating traction, such as customer acquisition, revenue growth, or product development milestones, to instill confidence in potential investors.

Investment Criteria and Expectations

- Angel Investors:

- Invest smaller amounts compared to venture capitalists, typically ranging from $10,000 to $100,000.

- Seek early-stage startups with high growth potential and a scalable business model.

- May provide mentorship and guidance in addition to funding.

- Venture Capitalists:

- Invest larger sums, often in the millions, in startups with the potential for significant returns.

- Focus on scalability, market size, and the strength of the founding team.

- Expect a high rate of return on their investment, typically aiming for an exit through an acquisition or IPO within a few years.

Crowdfunding Platforms for Small Businesses: Small Business Funding For Startups

Crowdfunding platforms provide a way for small businesses to raise funds from a large number of individuals, typically through online platforms. This method allows entrepreneurs to pitch their business ideas to a broader audience and attract potential investors who are interested in supporting innovative projects.

Examples of Successful Small Businesses Funded Through Crowdfunding, Small business funding for startups

- 1. Pebble Time Smartwatch: Pebble Technology raised over $20 million on Kickstarter to develop their smartwatch, making it one of the most successful crowdfunding campaigns at the time.

- 2. Oculus Rift: Oculus VR, a virtual reality company, raised $2.4 million on Kickstarter before being acquired by Facebook for $2 billion.

- 3. Exploding Kittens: A card game created by Elan Lee, Shane Small, and Matthew Inman, raised over $8.7 million on Kickstarter, becoming one of the most backed projects on the platform.

Pros and Cons of Using Crowdfunding as a Funding Source for Startups

- Pros:

- 1. Access to a wide pool of potential investors who can contribute small amounts.

- 2. Validation of the business idea through public interest and support.

- 3. Marketing and exposure for the business through the crowdfunding campaign.

- Cons:

- 1. Time-consuming process to create and manage a crowdfunding campaign.

- 2. Risk of not reaching the funding goal and losing credibility.

- 3. Platform fees and costs associated with running a crowdfunding campaign.

Summary

In conclusion, Small business funding for startups is a critical aspect that can determine the success of new ventures. By understanding the different funding methods and sources available, startups can navigate the financial landscape more effectively, ultimately leading to growth and sustainability.

When involved in a truck crash, seeking legal help is crucial. A truck crash attorney can provide guidance and support to navigate through the complexities of the legal process, ensuring your rights are protected.

For those looking to start a small business, securing funding is often a challenge. However, there are options available such as small business startup grants that can provide the financial boost needed to get your business off the ground.