Short-term startup loans provide a lifeline for new businesses seeking quick financial support, offering a unique approach to funding that sets them apart from traditional financing options. Dive into the world of short-term startup loans and discover how they can fuel your entrepreneurial dreams with ease.

Overview of Short-term Startup Loans

Short-term startup loans are a type of financing specifically designed to meet the needs of new businesses in their early stages. These loans differ from other types of financing, such as long-term loans or lines of credit, in that they are typically for smaller amounts and have shorter repayment periods.

When starting a small business, one of the biggest challenges is securing funding. Luckily, there are options like small business startup loans available to help entrepreneurs kickstart their ventures. These loans provide the necessary capital to cover initial costs and get the business off the ground.

Typical Terms and Conditions

Short-term startup loans usually come with higher interest rates compared to traditional long-term loans. They may also require more frequent payments, often on a weekly or monthly basis. Additionally, lenders may ask for a personal guarantee or collateral to secure the loan.

Suitable Financing Option

In situations where a new business needs quick access to funds to cover immediate expenses, such as purchasing inventory, hiring staff, or marketing efforts, short-term startup loans can be a suitable financing option. These loans provide the necessary capital to get the business off the ground without committing to long-term debt obligations.

For those in need of quick financial assistance to launch their business, quick startup loans can be a lifesaver. These loans offer a fast and convenient way to access funds without the lengthy approval process typical of traditional loans. With quick startup loans, entrepreneurs can get the capital they need to start their business without delay.

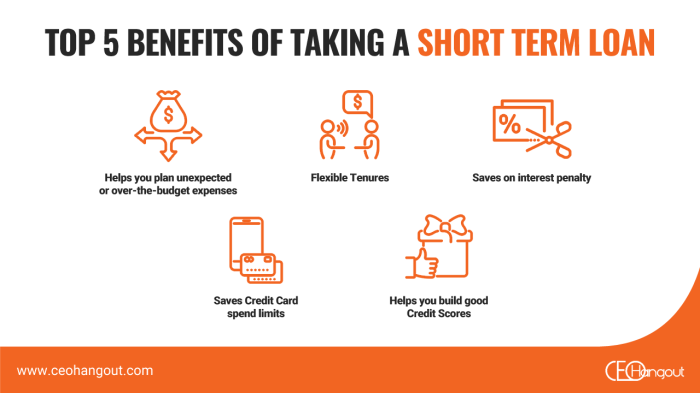

Benefits of Short-term Startup Loans

Short-term startup loans offer several advantages over long-term financing options. These loans are designed to provide quick access to capital without the lengthy repayment terms associated with traditional loans. Here are some key benefits of opting for short-term startup loans:

Immediate Financial Needs, Short-term startup loans

Short-term startup loans can help businesses address immediate financial needs such as purchasing inventory, covering payroll, or investing in marketing campaigns. These loans provide a quick infusion of cash to keep operations running smoothly during times of financial strain.

Flexibility and Speed

Unlike long-term loans that may require extensive paperwork and approval processes, short-term startup loans are typically easier to qualify for and can be approved quickly. This flexibility and speed make short-term loans a valuable option for businesses in need of immediate funds.

Less Interest Paid

Since short-term startup loans have shorter repayment periods, businesses end up paying less interest over the life of the loan compared to long-term financing options. This can result in cost savings for the business and help improve overall financial health.

Success Stories

Many businesses have successfully utilized short-term startup loans to overcome financial challenges and achieve growth. For example, a small retail company used a short-term loan to expand their product line and increase sales revenue. Another startup used a short-term loan to launch a new marketing campaign that led to a significant increase in customer acquisition.

Overall, short-term startup loans offer a valuable financial tool for businesses looking to address immediate needs and seize growth opportunities quickly. By providing quick access to capital, flexibility in repayment terms, and cost savings on interest, these loans can help businesses navigate financial hurdles and achieve long-term success.

Application Process for Short-term Startup Loans

When applying for a short-term startup loan, there are specific steps and requirements that need to be followed to ensure a smooth process from application to fund disbursement.

Steps Involved in Applying for a Short-term Startup Loan

- Research Lenders: Start by researching different lenders who offer short-term startup loans and compare their terms and interest rates.

- Prepare Documentation: Gather necessary documents such as business plan, financial statements, personal identification, and credit history.

- Submit Application: Fill out the loan application form provided by the lender and submit it along with the required documentation.

- Review and Approval: The lender will review your application, credit history, and business plan to determine approval.

Documentation and Information Required

- Business Plan: A detailed business plan outlining your startup idea, target market, revenue projections, and expenses.

- Financial Statements: Recent financial statements including income statement, balance sheet, and cash flow statement.

- Personal Identification: Valid identification such as driver’s license, passport, or social security number.

- Credit History: Details of your credit history, including credit score and any existing debts or loans.

Timeline for Approval and Disbursement of Funds

- Approval Process: The approval process for short-term startup loans can vary depending on the lender, but typically takes anywhere from a few days to a few weeks.

- Disbursement of Funds: Once approved, funds are usually disbursed within a few days to a week, either through direct deposit or check.

Risks and Considerations of Short-term Startup Loans

When considering short-term startup loans, it is crucial for businesses to be aware of the potential risks involved. Understanding these risks and knowing how to mitigate them can help make informed decisions when seeking short-term financing options.

Potential Risks of Short-term Startup Loans

- High Interest Rates: Short-term loans often come with higher interest rates compared to traditional long-term loans, increasing the overall cost of borrowing.

- Quick Repayment Periods: Short-term loans typically require faster repayment schedules, which can strain a startup’s cash flow if not managed properly.

- Limited Loan Amounts: Short-term loans may offer smaller loan amounts, which may not be sufficient to cover all startup expenses.

- Risk of Default: Due to the shorter repayment period and higher interest rates, there is an increased risk of default if the business faces financial challenges.

How to Mitigate Risks

- Assess Financial Health: Before applying for a short-term loan, businesses should conduct a thorough assessment of their financial health to ensure they can meet repayment obligations.

- Explore Alternatives: Consider other financing options such as grants, investors, or crowdfunding to reduce reliance on short-term loans.

- Create a Repayment Plan: Develop a detailed repayment plan that aligns with the business’s cash flow and revenue projections to ensure timely payments.

- Read the Fine Print: Carefully review the terms and conditions of the loan agreement to understand all fees, penalties, and repayment terms.

Factors to Consider Before Applying

- Business Stability: Evaluate the stability and growth potential of the business to determine if taking on debt is a viable option.

- Loan Purpose: Clearly define the purpose of the loan and how it will contribute to the business’s growth and sustainability.

- Cash Flow Analysis: Conduct a thorough analysis of the business’s cash flow to ensure it can support loan repayments without jeopardizing operations.

- Risk Tolerance: Consider the business owner’s risk tolerance and ability to handle financial obligations in case of unforeseen challenges.

Closing Summary

In conclusion, short-term startup loans offer a flexible and efficient way for budding entrepreneurs to secure the necessary funds to kickstart their ventures. With their tailored terms and rapid approval processes, these loans stand as a valuable resource for those looking to turn their business ideas into reality.