SBA startup loans are a crucial funding option for new businesses looking to kickstart their ventures. Dive into this comprehensive guide to understand the ins and outs of securing SBA startup loans and how they can benefit your entrepreneurial journey.

What are SBA startup loans?

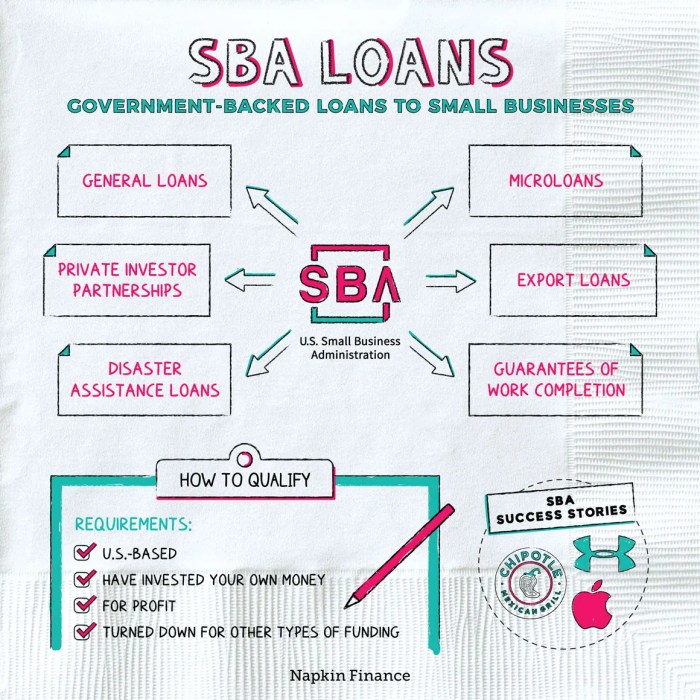

Startup loans offered by the Small Business Administration (SBA) are designed to provide financial assistance to new businesses with promising potential. These loans aim to help entrepreneurs kickstart their ventures by offering affordable financing options and support.

Eligibility Criteria for SBA Startup Loans

To be eligible for SBA startup loans, applicants must meet certain criteria, including having a solid business plan, demonstrating the ability to repay the loan, and having a good credit history. Additionally, applicants may be required to provide collateral or a personal guarantee to secure the loan.

Benefits of Obtaining SBA Startup Loans

- Lower interest rates compared to traditional loans, making repayment more manageable for new businesses.

- Longer repayment terms, giving entrepreneurs more time to establish their businesses and generate revenue.

- Access to valuable resources and support from the SBA, including mentorship programs and educational workshops.

- Potential to build a positive credit history by successfully repaying an SBA startup loan, which can benefit future financing opportunities.

How to apply for SBA startup loans?

When applying for SBA startup loans, it is essential to follow a structured process to increase your chances of approval. Here is a detailed guide on how to apply for SBA startup loans along with some tips for a successful application:

Application Process for SBA Startup Loans

Applying for SBA startup loans involves several steps that need to be carefully followed:

- Gather all necessary documentation, including business plan, financial statements, tax returns, and personal background information.

- Visit the SBA website to find a list of approved lenders who offer SBA startup loans.

- Choose a lender and fill out the loan application form, providing all required information accurately.

- Submit your application along with all supporting documents to the lender for review.

- Wait for the lender to assess your application and provide a decision.

Tips for a Successful SBA Startup Loan Application

Here are some tips to enhance your chances of approval when applying for SBA startup loans:

- Prepare a comprehensive business plan that Artikels your business idea, target market, competition, and financial projections.

- Maintain a good credit score and clean credit history to demonstrate your creditworthiness to the lender.

- Have a clear understanding of how much funding you need and how you plan to utilize the loan amount.

- Be honest and transparent in your application, providing accurate and up-to-date information to the lender.

Requirements for Different Types of SBA Startup Loans

Depending on the type of SBA startup loan you are applying for, the requirements may vary. Here is a comparison of the requirements for different types of SBA startup loans:

| Loan Program | Minimum Credit Score | Collateral Requirement | Maximum Loan Amount |

|---|---|---|---|

| 7(a) Loan Program | 680 | Varies | $5 million |

| Microloan Program | No minimum | Varies | $50,000 |

| 504 Loan Program | 680 | 40% collateral | $5.5 million |

Types of SBA startup loans

When it comes to SBA startup loans, there are different types available to meet the specific needs of entrepreneurs looking to start or expand their businesses.

SBA 7(a) loans

SBA 7(a) loans are one of the most common types of SBA startup loans. These loans can be used for various purposes, including working capital, refinancing debt, purchasing equipment, or real estate. They offer flexibility in terms of usage and repayment options, making them a popular choice for many startups.

SBA Microloans

On the other hand, SBA Microloans are designed for small businesses that need smaller amounts of capital. These loans are typically for amounts up to $50,000 and are often targeted towards startups and businesses in underserved communities. While they may have lower loan amounts compared to SBA 7(a) loans, they can still be a valuable resource for startups looking for initial funding.

SBA startup loans for minority entrepreneurs

SBA startup loans also offer specific features tailored for minority entrepreneurs. These features may include specialized programs, resources, and support aimed at helping minority-owned businesses succeed. By providing access to capital and business assistance, these loans can help level the playing field for minority entrepreneurs who may face additional challenges in starting and growing their businesses.

Managing SBA startup loans

Effective management of SBA startup loan funds is crucial for the success of your business. It involves strategic planning and financial discipline to ensure that the funds are utilized efficiently and for the intended purpose. Here are some strategies to consider:

Creating a detailed budget

- Artikel all the expenses associated with your business venture.

- Allocate funds accordingly to cover operational costs, marketing expenses, and other essential needs.

- Regularly review and adjust the budget as needed to stay on track.

Monitoring cash flow, SBA startup loans

- Keep a close eye on your cash flow to ensure that you have enough funds to meet your financial obligations.

- Implement cash flow management techniques to optimize the use of funds and maintain a healthy financial position.

- Address any cash flow issues promptly to prevent any financial setbacks.

Seeking professional financial advice

- Consider consulting with a financial advisor or accountant to help you make informed decisions regarding your SBA startup loan.

- Get expert guidance on managing your finances and maximizing the benefits of the loan.

- Utilize their expertise to navigate any financial challenges that may arise.

- Allocate any surplus funds towards repaying the loan ahead of schedule.

- Consider making bi-weekly or extra payments to reduce the principal amount and save on interest costs.

- Look for opportunities to increase your revenue or cut expenses to free up more funds for loan repayment.

- Stay committed to your repayment plan and make it a priority to clear the debt as soon as possible.

The consequences of defaulting on SBA startup loans

Defaulting on an SBA startup loan can have serious repercussions for your business. It can lead to damaged credit, legal action, and even the closure of your business. It is essential to communicate with your lender if you are facing difficulties in repaying the loan to explore alternative solutions and avoid default.

Tips for early repayment of SBA startup loans

Final Conclusion

In conclusion, SBA startup loans offer a lifeline to budding entrepreneurs, providing financial support and guidance for navigating the challenging startup landscape. With the right knowledge and approach, these loans can pave the way for business success.

When you find yourself in need of accident claim legal services , it’s crucial to seek assistance from professionals who specialize in this area. Dealing with the aftermath of an accident can be overwhelming, but having the right legal support can make all the difference in ensuring you receive the compensation you deserve.

If you’ve been involved in a hit and run incident, don’t hesitate to reach out to a skilled hit and run accident lawyer who can help navigate the legal process. They can provide guidance on your rights and work to secure a favorable outcome for your case.