Online startup funding sets the stage for entrepreneurs in the digital realm, exploring various avenues for financial support and growth. From crowdfunding to venture capital, this overview delves into the dynamic world of funding opportunities for online startups.

This guide aims to provide insights into the evolving landscape of online startup funding, shedding light on key strategies and resources for aspiring entrepreneurs in the digital age.

Understanding Online Startup Funding

Online startup funding refers to the financial support provided to new digital businesses through internet-based platforms. In the digital age, online startup funding has become increasingly significant due to the rise of e-commerce, technology startups, and the global reach of the internet.

When starting a new business, one of the key aspects to consider is securing fast startup business funding. This type of funding can provide the necessary capital to get your business off the ground quickly and efficiently, allowing you to focus on growing your venture.

Additionally, for startups looking to acquire equipment, there are options available such as equipment loans for startups that can help cover the costs of essential machinery and tools.

Key Sources of Online Startup Funding

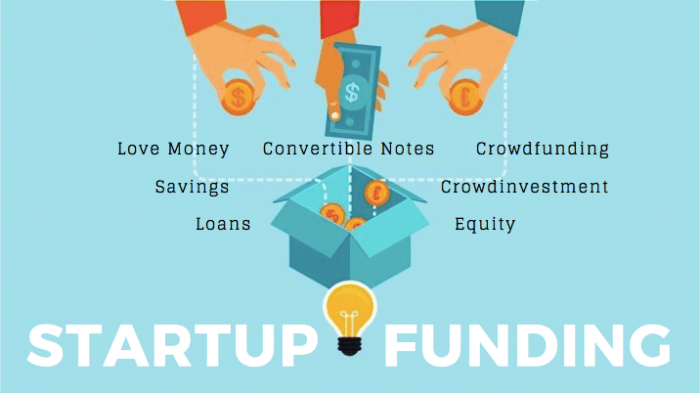

Entrepreneurs have access to various sources of online startup funding, including:

- Crowdfunding platforms like Kickstarter and Indiegogo, where individuals can invest in a project or product in exchange for rewards.

- Angel investors who provide capital in exchange for ownership equity in the startup.

- Venture capital firms that invest in high-growth potential startups in exchange for equity.

- Online peer-to-peer lending platforms that connect borrowers with individual lenders willing to fund their projects.

Differences Between Traditional Funding Methods and Online Startup Funding

Online startup funding differs from traditional funding methods in various ways:

- Accessibility: Online startup funding platforms provide entrepreneurs with easier access to a global network of investors compared to traditional funding sources.

- Speed: Online funding processes are often quicker and more streamlined than traditional funding methods, allowing startups to secure capital faster.

- Transparency: Online funding platforms offer greater transparency in terms of investment terms, funding progress, and investor interactions.

- Risk: Online startup funding may involve higher risk due to the lack of face-to-face interactions and the potential for regulatory challenges in different jurisdictions.

Crowdfunding for Startups

Crowdfunding has become a popular way for startups to raise capital by collecting small amounts of money from a large number of people, typically via online platforms. This method allows entrepreneurs to bypass traditional funding sources like banks or venture capitalists and instead directly engage with potential investors or backers.

Types of Crowdfunding Models

- Reward-Based Crowdfunding: In this model, backers receive a reward or product in exchange for their financial support. Platforms like Kickstarter and Indiegogo operate on this model, where startups offer early access to their products or exclusive rewards to incentivize contributions.

- Equity Crowdfunding: This model involves investors receiving equity or ownership in the startup in exchange for their funding. Platforms like SeedInvest and Crowdcube enable startups to sell shares of their company to a large number of investors, allowing for broader participation in the company’s success.

- Debt Crowdfunding: Also known as peer-to-peer lending, this model involves startups borrowing money from individuals through online platforms. Startups repay the borrowed amount with interest over a specified period. Platforms like Lending Club and Funding Circle facilitate this type of crowdfunding.

Successful Startups Utilizing Crowdfunding

- Oculus Rift: The virtual reality company raised over $2.4 million through Kickstarter, paving the way for its eventual acquisition by Facebook for $2 billion.

- Pebble: The smartwatch manufacturer raised over $20 million on Kickstarter, becoming one of the most successful crowdfunding campaigns at the time.

- Exploding Kittens: A card game company raised over $8 million on Kickstarter, showcasing the power of crowdfunding for creative projects.

Venture Capital and Angel Investors

When it comes to funding online startups, venture capital firms and angel investors play a crucial role in providing the necessary capital for growth and development.

When starting a new business, one of the key factors to consider is obtaining fast startup business funding. This financial support can help kickstart your venture and ensure smooth operations from the beginning. Additionally, exploring options such as equipment loans for startups can provide the necessary resources to acquire essential tools and machinery for your business.

By securing the right funding and equipment loans, you can set your startup on the path to success.

Venture Capital Firms

Venture capital firms are investment companies that provide funding to startups and small businesses in exchange for equity ownership. They typically invest larger amounts of money in more established startups that show high growth potential.

- Venture capital firms often take an active role in the management of the startup they invest in, providing guidance, expertise, and networking opportunities.

- They look for startups with a scalable business model, a strong management team, a competitive advantage, and a clear path to profitability.

- Venture capitalists are looking for startups that can offer a high return on their investment within a relatively short timeframe, usually within 5-7 years.

Angel Investors

Angel investors are individuals who provide capital to startups, usually in the early stages of development. They offer smaller amounts of funding compared to venture capital firms but can be crucial for startups in the initial phases.

- Angel investors are often successful entrepreneurs or business professionals who not only provide funding but also mentorship and valuable connections.

- They are more willing to take risks compared to traditional investors and are attracted to innovative ideas and passionate founders.

- Angel investors look for startups with a strong value proposition, a clear market need, a dedicated team, and a realistic growth plan.

Bootstrapping and Self-funding

Bootstrapping and self-funding are common methods used by entrepreneurs to finance their online startups without relying on external investors. This approach allows founders to maintain full control over their business and decision-making processes.

Bootstrapping as a Method of Funding, Online startup funding

Bootstrapping involves using personal savings, credit cards, or revenue generated by the business to fund its operations. This method requires founders to be resourceful and frugal in managing their finances to ensure the startup’s sustainability.

- Bootstrap from personal savings: Founders can invest their own money into the startup to cover initial expenses such as website development, marketing, and product testing.

- Utilize credit cards: Some entrepreneurs use credit cards to finance their startup’s expenses, but this approach comes with high-interest rates and potential debt accumulation.

- Rely on revenue generated by the business: By reinvesting profits back into the startup, founders can fuel its growth and expansion without seeking external funding.

Bootstrapping requires founders to be financially disciplined and willing to make sacrifices to ensure the success of their startup.

Strategies for Self-funding a Startup

Self-funding a startup can be approached in various ways, each with its own set of advantages and disadvantages.

- Start small and scale gradually: Begin with a minimal viable product (MVP) to test the market demand before investing significant capital into the business.

- Focus on generating revenue early: Prioritize sales and revenue generation to fund ongoing operations and reduce the need for external financing.

- Control expenses and prioritize essential investments: Avoid unnecessary expenses and focus on investments that directly contribute to the growth and sustainability of the startup.

Self-funding allows founders to retain full ownership and decision-making authority over their startup, but it may limit the business’s growth potential due to resource constraints.

Tips for Entrepreneurs Considering Bootstrapping or Self-funding

For entrepreneurs weighing the option of bootstrapping or self-funding their online startup, it is essential to consider the following tips:

- Develop a clear financial plan: Artikel your startup’s financial needs, revenue projections, and expenses to determine the feasibility of bootstrapping or self-funding.

- Seek mentorship and guidance: Connect with experienced entrepreneurs or advisors who can provide insights and guidance on managing finances and making strategic decisions.

- Be prepared for challenges: Bootstrapping and self-funding require resilience and determination, as you may face financial obstacles and constraints along the way.

Closure

In conclusion, Online startup funding offers a plethora of options for new businesses to thrive and expand. By understanding the diverse funding sources and methods available, entrepreneurs can navigate the digital investment landscape with confidence and strategic foresight.