Non-bank startup funding opens up a world of diverse investment opportunities for emerging businesses, steering away from traditional banking institutions. Exploring this alternative route can lead to unique advantages and challenges that shape the entrepreneurial landscape.

As we delve deeper into the nuances of non-bank startup funding, we uncover the various types of funding options, strategies for securing investments, and the profound impact it has on the growth and decision-making processes of startups.

Overview of Non-bank Startup Funding

Non-bank startup funding refers to financial support provided to new businesses by entities other than traditional banks. These alternative funding sources can include venture capital firms, angel investors, crowdfunding platforms, and peer-to-peer lending networks.

Examples of Non-bank Funding Sources for Startups

- Venture Capital: Venture capital firms invest in early-stage companies with high growth potential in exchange for equity.

- Angel Investors: Individual investors who provide capital to startups in exchange for ownership equity or convertible debt.

- Crowdfunding Platforms: Online platforms where entrepreneurs can raise funds from a large number of individuals for their business ideas.

- Peer-to-Peer Lending: Platforms that connect borrowers directly with lenders, cutting out the traditional banking system.

Advantages of Seeking Funding from Non-bank Sources

- Flexibility: Non-bank funding sources often offer more flexible terms and conditions compared to traditional banks.

- Expertise: Investors from non-bank sources often bring valuable expertise and networks to help startups grow.

- Faster Access: Startups can often access funding more quickly from non-bank sources, speeding up their growth trajectory.

Challenges Associated with Non-bank Startup Funding

- Higher Costs: Non-bank funding options may come with higher interest rates or equity stakes, leading to increased costs for startups.

- Risk of Dilution: In exchange for funding, startups may have to give up a portion of ownership, potentially diluting the founders’ control over the company.

- Lack of Regulation: Non-bank funding sources may not be subject to the same regulations as traditional banks, leading to potential risks for startups.

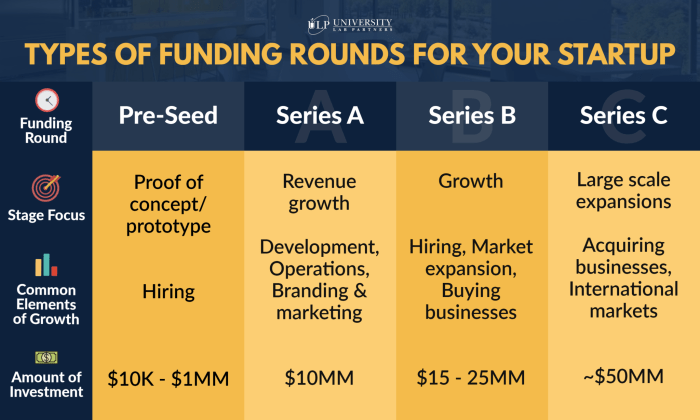

Types of Non-bank Startup Funding

When it comes to funding options for startups, non-bank sources play a crucial role in providing the necessary capital for growth and expansion. Let’s explore the different types of non-bank funding available to startups.

Venture Capital

Venture capital is a type of private equity funding provided by investors to startups and small businesses with long-term growth potential. These investors usually take an equity stake in the company in exchange for funding, and they often provide mentorship and guidance along with the capital.

When involved in a vehicle accident, seeking the help of a vehicle accident injury lawyer is crucial. These legal experts specialize in handling cases related to personal injuries sustained in accidents. They can assist in navigating the complexities of insurance claims and legal proceedings to ensure fair compensation for their clients.

Angel Investors

Angel investors are individuals who invest their personal funds in startups in exchange for equity ownership. They are typically high-net-worth individuals who provide capital at the early stages of a business in exchange for a share of the company.

When you find yourself in need of legal assistance after a vehicle accident, it’s crucial to seek the help of a professional vehicle accident injury lawyer who can guide you through the process. Similarly, if you are involved in a head-on collision, a skilled head-on collision lawyer can provide the support and expertise you need to navigate the complexities of your case.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically through online platforms. Startups can use crowdfunding to validate their ideas, gain market exposure, and raise capital without giving up equity.

Other Non-bank Funding Sources

Other non-bank funding sources for startups include accelerators, incubators, grants, and competitions. Accelerators and incubators provide funding, mentorship, and resources to help startups grow rapidly. Grants are non-repayable funds provided by government agencies, foundations, or corporations to support specific projects or initiatives. Competitions offer startups the opportunity to pitch their ideas and win funding based on their business concepts.

Criteria and Requirements for Startup Funding

Startups looking to qualify for non-bank funding must typically demonstrate a strong business model, a scalable product or service, a competent team, and a clear growth strategy. Investors and funding sources will also consider factors such as market potential, competitive landscape, and the startup’s ability to execute on its plans.

In cases of head-on collisions, hiring a skilled head-on collision lawyer is essential. These attorneys have the expertise to investigate the circumstances of the collision and determine liability. By representing clients in court and negotiating settlements, they strive to secure the best possible outcome for those affected by such devastating accidents.

Strategies for Securing Non-bank Startup Funding

Securing non-bank startup funding can be a crucial step in the growth and success of your business. Here are some strategies to help you attract non-bank investors and build relationships with funding sources.

Tips for Attracting Non-bank Investors, Non-bank startup funding

When looking to attract non-bank investors, it’s essential to:

- Clearly Artikel your business model and potential for growth.

- Demonstrate a solid understanding of your target market and competitive landscape.

- Showcase a strong team with relevant experience and skills.

- Highlight any traction or milestones achieved to date.

Building Relationships with Non-bank Funding Sources

Developing relationships with non-bank funding sources involves:

- Networking and attending industry events to meet potential investors.

- Engaging with investors through personalized communication and follow-ups.

- Being transparent about your business and financials to build trust.

- Seeking mentorship from experienced investors to guide you through the funding process.

Key Components of a Successful Non-bank Funding Pitch

When pitching for non-bank funding, make sure to include:

- A compelling story that resonates with investors and showcases your passion.

- A detailed business plan outlining your market opportunity, revenue model, and growth strategy.

- Financial projections that are realistic and backed by thorough research.

- A clear ask for funding, specifying how the funds will be used and the potential return on investment.

Impact of Non-bank Startup Funding

Non-bank startup funding plays a crucial role in the growth and scalability of emerging businesses. It provides alternative sources of capital that can fuel innovation, expansion, and development.

Non-bank Funding Influence on Startup Decision-Making

Non-bank funding significantly influences the decision-making process for startups. Unlike traditional bank loans, non-bank funding options offer more flexibility in terms of repayment terms, collateral requirements, and funding amounts. This allows startups to tailor their funding strategy to align with their specific business needs and goals.

Success Stories of Startups Thriving with Non-bank Funding

- One success story is that of a tech startup that secured non-bank funding through a venture capital firm. With this funding, the startup was able to accelerate product development, expand its market reach, and ultimately achieve a successful exit through acquisition.

- Another example is a consumer goods startup that opted for crowdfunding as a non-bank funding option. Through a successful crowdfunding campaign, the startup not only raised the necessary capital but also built a loyal customer base and generated buzz around its brand.

- Furthermore, a biotech startup received non-bank funding from angel investors, enabling them to conduct critical research, secure patents, and eventually bring a life-saving medical device to market.

Final Summary

In conclusion, non-bank startup funding serves as a dynamic force in the realm of entrepreneurial finance, offering a pathway for innovation and growth outside the conventional banking sphere. By embracing this approach, startups can tap into a rich tapestry of resources and support to fuel their journey towards success.