Low-interest startup loans provide a viable solution for new businesses seeking financial support, offering competitive rates and favorable terms to help entrepreneurs kickstart their ventures. As we delve into the world of startup financing, let’s explore the ins and outs of this popular funding option.

From understanding the concept to navigating the application process, this guide aims to equip you with valuable insights to make informed decisions for your entrepreneurial journey.

What are low-interest startup loans?

Startup loans with low interest rates are financial products specifically designed to provide funding to new businesses at a lower cost compared to traditional loans. These loans aim to support entrepreneurs in getting their business off the ground without burdening them with high-interest payments.

Examples of financial institutions offering low-interest startup loans

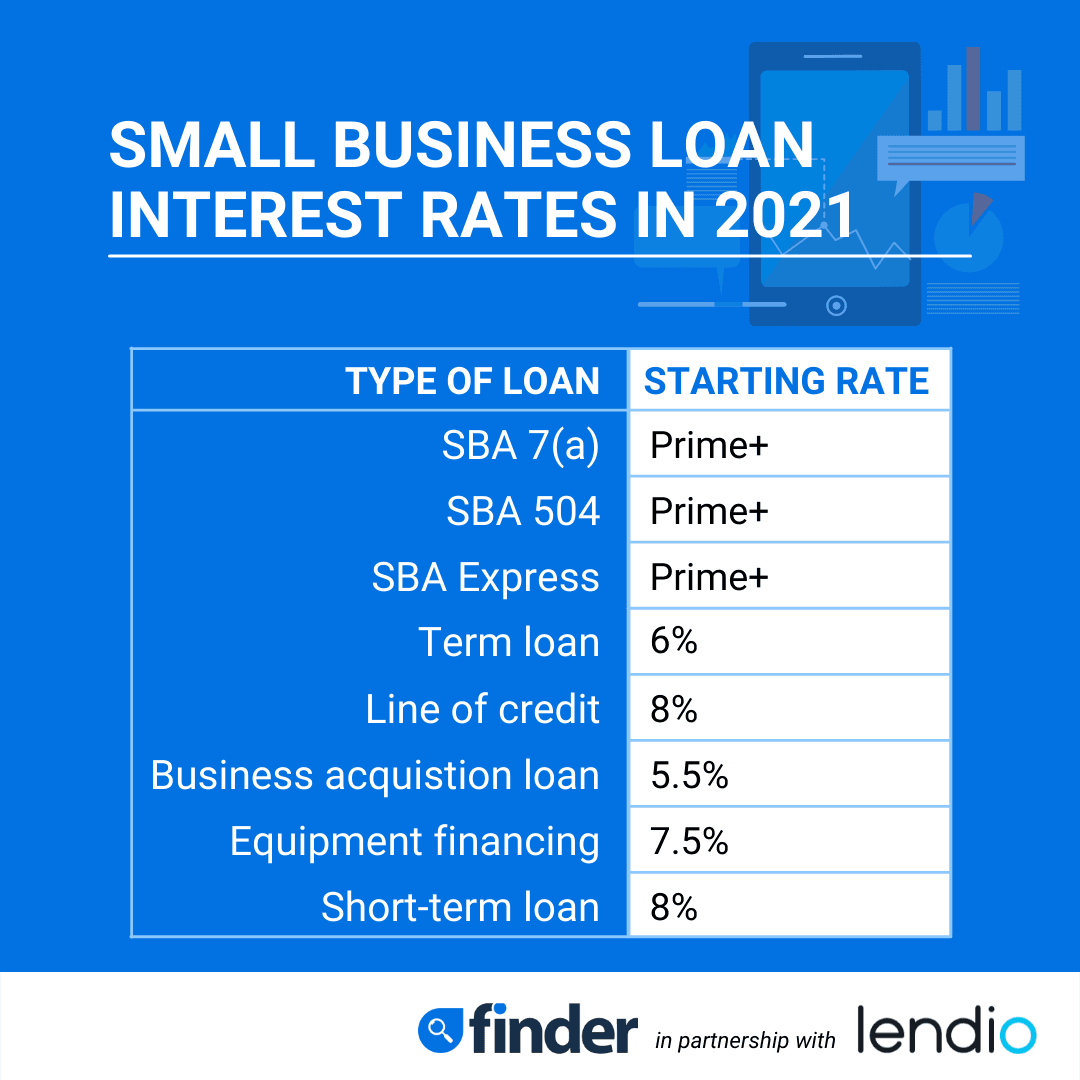

- Small Business Administration (SBA): The SBA offers various loan programs with competitive interest rates for startups.

- Local credit unions: Many credit unions provide low-interest loans to support small businesses in the community.

- Online lenders: Some online lenders specialize in offering startup loans with favorable terms and low interest rates.

Benefits of opting for low-interest startup loans

- Cost-effective financing: Low-interest rates mean lower overall costs for borrowing, helping new businesses manage their finances more effectively.

- Improved cash flow: Lower interest payments ensure that more money stays within the business for operational expenses and growth opportunities.

- Lower risk: With manageable interest rates, startups can avoid the financial strain of high debt payments and focus on building a sustainable business.

Qualifications for low-interest startup loans

When it comes to qualifying for low-interest startup loans, there are specific requirements that borrowers need to meet in order to secure this type of financing. Typically, these qualifications focus on factors like credit score, business plan, and financial history.

Credit Score Requirement

In order to qualify for low-interest startup loans, borrowers generally need to have a good to excellent credit score. Lenders use credit scores as a way to assess the risk of lending money to an individual or business. A higher credit score indicates a lower risk, making it more likely for borrowers to secure low-interest rates on their loans.

Eligibility Criteria Comparison

When comparing traditional loans to low-interest startup loans, there are some key differences in the eligibility criteria. Traditional loans often require a strong credit history, collateral, and a proven track record of financial stability. On the other hand, low-interest startup loans may be more lenient in terms of credit score requirements and financial history, as they are specifically designed to support new businesses and entrepreneurs.

Overall, the qualifications for low-interest startup loans are focused on ensuring that borrowers have the ability to repay the loan while also supporting the growth and development of their business ventures.

How to apply for low-interest startup loans

Applying for low-interest startup loans can be a crucial step in getting your business off the ground. Here’s a detailed guide on how to navigate through the application process effectively.

When you find yourself in need of legal assistance after an accident, it’s crucial to seek help from a reputable accident law firm. These firms specialize in handling cases related to personal injuries caused by accidents, ensuring you receive the compensation you deserve.

Step-by-step process of applying for low-interest startup loans

- Research: Begin by researching different lenders and financial institutions that offer low-interest startup loans. Compare their terms, interest rates, and eligibility criteria to find the best fit for your business.

- Prepare your business plan: A solid business plan is essential when applying for a startup loan. Make sure to include detailed information about your business idea, target market, financial projections, and how the loan will be utilized.

- Check your credit score: Lenders often consider your credit score when reviewing loan applications. Ensure your credit score is in good standing to increase your chances of approval for a low-interest loan.

- Complete the application: Fill out the loan application form accurately and provide all the required documentation, such as personal identification, financial statements, and business documents.

- Submit your application: Once you have completed the application form and gathered all necessary documents, submit your application to the lender for review.

- Follow up: Stay in touch with the lender and be prepared to provide any additional information they may request during the review process.

Tips to improve chances of approval for low-interest startup loans

- Build a strong credit profile: Maintain a good credit score and work on improving it if necessary before applying for a loan.

- Show a clear business plan: Demonstrate a well-thought-out business plan that showcases your understanding of the market and your business’s potential for success.

- Provide collateral: Offering collateral can increase your chances of approval for a low-interest loan as it reduces the lender’s risk.

- Seek professional advice: Consider consulting with financial advisors or mentors to get guidance on the loan application process and how to strengthen your application.

Documentation needed when applying for low-interest startup loans

- Personal identification: A valid ID such as a driver’s license or passport.

- Financial statements: Including bank statements, tax returns, and any other financial documents that show your financial stability.

- Business documents: Incorporation documents, business licenses, and any other legal paperwork related to your business.

- Business plan: A detailed business plan that Artikels your business idea, market analysis, financial projections, and how the loan will be utilized.

Alternatives to low-interest startup loans

When seeking funding for a new startup, there are various alternatives to low-interest loans that entrepreneurs can explore. Each option comes with its own set of pros and cons, so it’s important to consider the advantages and disadvantages of different financing methods before making a decision.

Venture Capital Funding

Venture capital funding involves investors providing capital to startups in exchange for equity in the company. This type of funding can be beneficial for startups looking to scale quickly and have access to industry expertise. However, it often comes with the trade-off of giving up some control and ownership of the business.

Angel Investors, Low-interest startup loans

Angel investors are individuals who invest their own money into startups in exchange for equity. This type of funding can be more flexible than traditional loans and may come with valuable mentorship and networking opportunities. On the flip side, angel investors may also have a say in the direction of the business.

Crowdfunding

Crowdfunding platforms allow startups to raise funds from a large number of individuals online. This method can help validate the market demand for a product or service and create a community of loyal customers. However, running a successful crowdfunding campaign requires a significant amount of time and effort.

Bootstrapping

Bootstrapping involves using personal savings or revenue generated by the business to fund its growth. While this method allows for complete control and ownership, it can limit the speed at which the startup can scale. Entrepreneurs may also need to make sacrifices in their personal finances to fund the business.

Concluding Remarks: Low-interest Startup Loans

In conclusion, low-interest startup loans serve as a practical and cost-effective way for startups to secure the necessary capital to fuel their growth. By weighing the benefits and exploring alternative financing avenues, aspiring entrepreneurs can pave the path to success with confidence and financial stability.

Looking for the best personal injury lawyer to represent you in court? A skilled lawyer can navigate the complexities of personal injury cases, ensuring your rights are protected and fighting for the compensation you are entitled to.