Financing for early-stage startups sets the stage for success in the competitive business landscape. Understanding the various funding options and strategies is essential for entrepreneurs looking to take their ideas to the next level.

In the following sections, we will delve into the world of startup financing, exploring key concepts such as angel investors, venture capitalists, pitching to investors, and alternative financing methods.

Overview of Financing for Early-Stage Startups

Early-stage startups refer to newly established companies that are in the initial phase of operations and product development. These startups are typically in the early stages of growth and are looking to scale their business.

Securing financing is crucial for the growth of early-stage startups as it provides the necessary capital to fund operations, develop products, hire employees, and scale the business. Without adequate financing, startups may struggle to survive and grow in the competitive market.

When starting a small business, finding the right funding can be a challenge. One option to explore is applying for small business startup grants which can provide financial support without the need for repayment. Additionally, entrepreneurs can also consider alternative sources such as non-bank startup funding options that offer flexible terms and competitive rates.

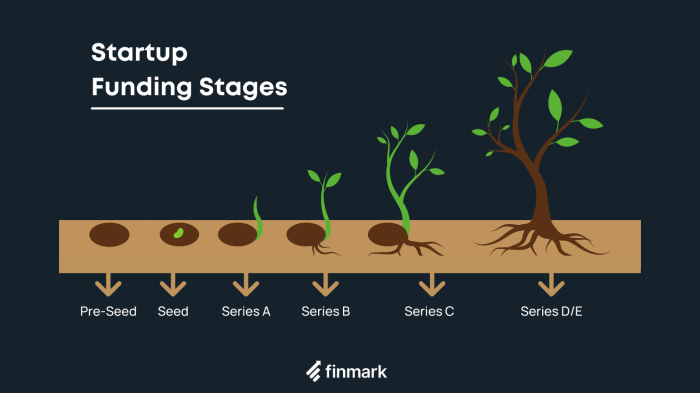

Types of Financing Options for Early-Stage Startups

- Bootstrapping: Bootstrapping involves funding the startup using personal savings, revenue generated from sales, or loans from friends and family. This option gives founders full control over the business but may limit growth potential due to limited resources.

- Angel Investors: Angel investors are individuals who provide capital in exchange for ownership equity or convertible debt. They often offer expertise and mentorship in addition to funding.

- Venture Capital: Venture capital firms invest in early-stage startups with high growth potential in exchange for equity. They provide larger funding amounts but often require a significant portion of ownership.

- Crowdfunding: Crowdfunding platforms allow startups to raise funds from a large number of individuals in exchange for rewards, equity, or debt. This option can help startups validate their idea and generate buzz.

Bootstrapping vs. Seeking External Financing, Financing for early-stage startups

Bootstrapping involves self-funding the startup, which can be advantageous for founders who want to maintain control and ownership of the business. However, it may limit the growth potential of the startup due to resource constraints.

On the other hand, seeking external financing from investors like angel investors or venture capitalists can provide startups with the necessary capital to accelerate growth and scale the business. While this option may involve giving up ownership and control to some extent, it can help startups reach their full potential in a competitive market.

When starting a small business, finding the necessary funding can be a challenge. One option to explore is applying for small business startup grants , which can provide financial assistance to get your business off the ground. Another alternative is seeking non-bank startup funding , which offers different financing options outside of traditional banks.

These resources can be valuable in helping entrepreneurs turn their business ideas into reality.

Angel Investors and Venture Capitalists

Angel investors and venture capitalists play crucial roles in the startup ecosystem by providing early-stage financing to innovative businesses. While both types of investors can fuel a startup’s growth, they differ in their investment criteria, approach, and level of involvement.

Angel Investors

Angel investors are typically high-net-worth individuals who invest their personal funds into startups in exchange for equity. They often have entrepreneurial backgrounds and can offer valuable mentorship and connections in addition to capital. Angel investors are more flexible in their investment criteria compared to venture capitalists, as they may be willing to take on higher risks and invest in a wider range of industries.

- Angel investors focus on early-stage startups that have the potential for rapid growth.

- They typically invest smaller amounts of capital compared to venture capitalists.

- Angel investors are more hands-on and involved in the day-to-day operations of the startup.

- Securing funding from angel investors can be quicker and less bureaucratic than from venture capitalists.

Venture Capitalists

Venture capitalists are professional investment firms that manage pooled funds from institutional investors, such as pension funds and wealthy individuals. They invest in startups with high growth potential in exchange for equity and typically provide larger funding rounds compared to angel investors. Venture capitalists have a more structured approach to investing and often have specific investment criteria based on industry, stage of the startup, and expected returns.

- Venture capitalists focus on startups that have proven their business model and are ready to scale.

- They invest larger amounts of capital and may require a significant ownership stake in the startup.

- Venture capitalists provide strategic guidance and help startups access additional funding rounds.

- Securing funding from venture capitalists can validate a startup’s potential and attract follow-on investors.

It’s essential for startups to carefully consider the pros and cons of securing funding from angel investors versus venture capitalists to determine the best fit for their growth strategy and long-term success.

Pitching to Investors

When it comes to pitching to investors, early-stage startups need to make sure they have a compelling presentation that clearly conveys their business idea, market potential, and team. This is a crucial step in securing financing for their venture.

Preparing a Compelling Pitch

- Start by clearly defining your business idea and the problem it solves. Investors need to understand the value proposition of your startup.

- Highlight the market potential by showcasing the size of the market, your target audience, and how your solution addresses their needs.

- Showcase your team’s expertise and experience, emphasizing why they are the right people to execute the business plan.

- Create a strong narrative that captures the attention of investors and keeps them engaged throughout the presentation.

Key Components of a Pitch Deck

- Executive summary: Provide a brief overview of your business, including the problem, solution, market potential, and team.

- Problem statement: Clearly define the problem your startup is solving and why it is important.

- Solution: Explain how your product or service addresses the problem and why it is unique.

- Market analysis: Present data on the market size, trends, and competition to demonstrate the opportunity for growth.

- Business model: Artikel your revenue streams, pricing strategy, and sales projections.

- Team: Introduce key team members and their roles, highlighting their relevant experience and expertise.

- Financial projections: Provide realistic financial forecasts, including revenue projections, expenses, and funding requirements.

Effective Communication with Investors

- Be concise and to the point: Investors have limited time, so focus on the most important aspects of your business.

- Practice your pitch: Rehearse your presentation to ensure you can deliver it confidently and effectively.

- Be prepared for questions: Anticipate potential questions from investors and have well-thought-out answers ready.

- Show passion and enthusiasm: Investors are more likely to invest in a startup whose founders are genuinely passionate about their business.

Common Mistakes to Avoid

- Overcomplicating the pitch: Keep your presentation simple and easy to understand to avoid confusing investors.

- Overselling or exaggerating: Be honest and transparent about your startup’s progress and potential.

- Ignoring feedback: Listen to investors’ feedback and be open to making changes to your pitch based on their suggestions.

- Lack of preparation: Make sure you are well-prepared and have all the necessary information and materials ready before pitching to investors.

Crowdfunding and Alternative Financing Options

Crowdfunding and alternative financing options play a crucial role in providing early-stage startups with the necessary capital to kickstart their businesses and fuel growth. These avenues offer innovative ways for entrepreneurs to secure funding outside of traditional sources like angel investors or venture capitalists.

Crowdfunding Platforms for Startups

- Kickstarter: A popular platform for creative projects, allowing startups to pitch their ideas to a large audience and secure funding from individual backers.

- Indiegogo: Another crowdfunding platform that caters to a wide range of projects, offering flexible funding options for startups.

- SeedInvest: Specializing in equity crowdfunding, SeedInvest connects startups with accredited investors looking to support early-stage companies in exchange for equity.

Alternative Financing Options

Aside from crowdfunding, startups can explore alternative financing options to raise capital:

- Grants: Government grants and private foundations offer non-dilutive funding to startups working on specific projects or in certain industries.

- Loans: Startups can opt for traditional bank loans or explore microloans and online lending platforms to secure capital with varying interest rates and repayment terms.

- Accelerators: Startup accelerators provide funding, mentorship, and resources in exchange for equity, helping startups grow rapidly and access valuable networks.

Successful Startups leveraging Crowdfunding and Alternative Financing

- Oculus VR: The virtual reality company raised over $2 million through Kickstarter before being acquired by Facebook for $2 billion, showcasing the power of crowdfunding in propelling startups to success.

- Warby Parker: The eyewear brand raised seed funding through angel investors and venture capitalists but also secured financing through a mix of grants and loans to fuel its rapid expansion and disrupt the industry.

Closure

In conclusion, navigating the realm of financing for early-stage startups can be challenging but rewarding. By leveraging the right funding sources and strategies, entrepreneurs can fuel their growth and bring their innovative ideas to life.