Fast startup business funding opens doors to success, showing how quick access to funding can transform new businesses. Explore the impact, strategies, and challenges in this dynamic world of entrepreneurship.

Importance of Fast Startup Business Funding

Fast startup business funding plays a crucial role in the success and growth of new businesses. The ability to access funding quickly can make a significant difference in the trajectory of a startup, allowing it to capitalize on opportunities and overcome challenges.

Dealing with a hit and run incident can be overwhelming, but a Hit and run lawyer can provide you with the support and guidance you need. Don’t hesitate to seek legal help to protect your rights and seek justice.

Impact of Fast Funding on Startup Growth

Fast funding can provide startups with the resources they need to scale their operations, develop new products, and enter new markets. By securing funding quickly, startups can accelerate their growth and stay ahead of the competition.

If you’ve been involved in a rear-end crash and need legal assistance, it’s crucial to consult a Rear-end crash attorney. They can help you navigate the legal process and ensure you receive the compensation you deserve.

- Rapid funding can enable startups to hire top talent, invest in marketing campaigns, and upgrade their technology infrastructure.

- Access to quick funding can also help startups weather unexpected financial crises or take advantage of time-sensitive opportunities.

- Companies like Uber, Airbnb, and Snapchat are examples of startups that benefited from fast funding, allowing them to quickly expand their operations and establish themselves as industry leaders.

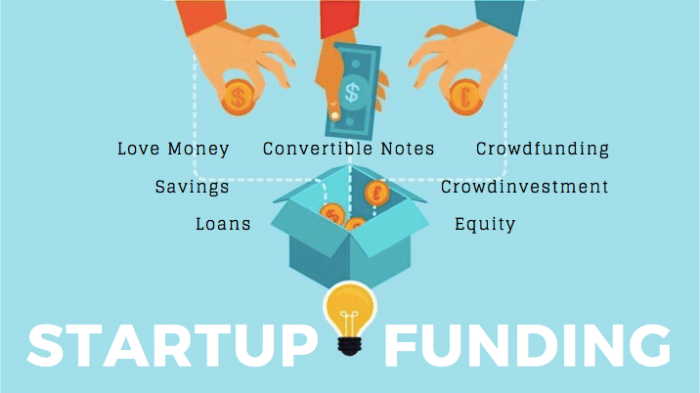

Sources of Fast Startup Business Funding

When it comes to funding a new startup, there are various sources that entrepreneurs can tap into to get their businesses off the ground quickly. Each funding source has its own advantages and disadvantages, as well as specific criteria and requirements for accessing funds. Let’s explore some of the common sources of fast startup business funding:

Angel Investors

Angel investors are individuals who provide capital for startups in exchange for ownership equity or convertible debt. They are typically high-net-worth individuals who invest their own money in early-stage businesses.

- Advantages: Quick decision-making process, mentorship opportunities, flexible terms.

- Disadvantages: High equity stake, potential conflicts with investors, limited funding amount.

- Criteria and Requirements: Strong business idea, scalable business model, convincing pitch presentation.

Venture Capital

Venture capital firms invest in startups with high growth potential in exchange for equity. They typically invest larger amounts of money than angel investors and provide strategic guidance to help the business grow.

- Advantages: Significant funding, access to industry networks, expertise in scaling businesses.

- Disadvantages: Loss of control, pressure to achieve rapid growth, strict investment criteria.

- Criteria and Requirements: Scalable business model, experienced team, large market opportunity.

Crowdfunding

Crowdfunding platforms allow entrepreneurs to raise capital from a large number of individual investors online. This source of funding can be a quick way to access funds and validate the market demand for a product or service.

- Advantages: Broad investor base, market validation, no equity dilution.

- Disadvantages: Time-consuming campaign creation, platform fees, risk of failure to reach funding goal.

- Criteria and Requirements: Compelling story, engaging marketing campaign, clear funding goal.

Small Business Loans

Traditional small business loans from banks or online lenders provide a quick source of funding for startups that have a solid credit history and business plan. These loans typically have fixed repayment terms and interest rates.

- Advantages: Quick access to funds, predictable repayment schedule, building credit history.

- Disadvantages: Interest payments, collateral requirements, stringent application process.

- Criteria and Requirements: Good credit score, viable business plan, collateral or personal guarantee.

Strategies to Secure Fast Business Funding

Securing fast business funding is crucial for startups looking to scale quickly and stay ahead in the competitive market. Implementing the right strategies can help entrepreneurs secure the necessary capital to fuel their growth and success.

Preparing a Compelling Pitch Deck, Fast startup business funding

Creating a compelling pitch deck is essential when seeking funding from potential investors. A well-crafted pitch deck should clearly Artikel your business model, target market, financial projections, and unique selling proposition. Make sure to include visually engaging graphics and data points to capture the attention of investors and convey the potential of your business.

Importance of Networking and Building Relationships

Networking and building relationships with investors, industry experts, and other entrepreneurs can significantly accelerate the funding process. Attend networking events, industry conferences, and startup incubators to connect with potential investors and gain valuable insights. Building strong relationships can lead to introductions to key decision-makers and increase your chances of securing fast funding.

Tips for Accelerating the Funding Application Process

1. Be prepared: Have all your financial documents, business plans, and pitch deck ready before approaching investors.

2. Target the right investors: Research and target investors who have a history of investing in your industry or type of business.

3. Leverage online platforms: Utilize online crowdfunding platforms or angel investor networks to reach a wider pool of investors quickly.

4. Follow up promptly: After pitching your business idea, follow up with investors promptly to keep the momentum going and address any questions or concerns they may have.

5. Be persistent: Securing funding can be a challenging process, so stay persistent and keep refining your pitch based on feedback from potential investors.

Challenges in Obtaining Fast Business Funding

Securing fast funding for a startup can be a daunting task due to various challenges that entrepreneurs often face. These obstacles can significantly hinder the growth and success of a new business venture.

Lack of Collateral

One common challenge for startups is the lack of tangible assets to use as collateral when seeking funding. Traditional lenders often require collateral to mitigate the risk of lending to new businesses.

- Explore alternative funding options such as angel investors or venture capitalists who may be willing to invest in your business without collateral.

- Build a strong business plan and pitch to demonstrate the potential for growth and profitability, which can help attract investors despite the lack of collateral.

Limited Credit History

Another challenge faced by startups is the limited credit history of the business or its founders, making it difficult to qualify for traditional loans or lines of credit.

- Establish trade credit relationships with suppliers or vendors to start building a business credit history.

- Consider applying for a business credit card or a small business loan from online lenders that specialize in working with startups and businesses with limited credit history.

High Risk Perception

Startups are often perceived as high-risk investments by lenders and investors, leading to difficulties in securing fast funding.

- Showcase a strong management team with relevant experience and expertise to mitigate the perceived risk associated with investing in a startup.

- Focus on demonstrating market potential, scalability, and a clear path to profitability to attract investors despite the perceived risks.

Last Recap

In conclusion, Fast startup business funding is not just about money; it’s about seizing opportunities and turning dreams into reality. Dive into the world of rapid funding and witness the birth of innovative startups.