Crowdfunding for startups takes center stage, offering a unique way for new businesses to raise funds and validate their ideas. This innovative approach allows entrepreneurs to connect with a wider audience and access the capital needed to kickstart their ventures. In this dynamic landscape, the role of crowdfunding in empowering startups is undeniable, shaping the future of entrepreneurship.

As we delve deeper into the realm of crowdfunding for startups, we uncover valuable insights into the different models available, essential tips for running successful campaigns, and the legal considerations that entrepreneurs must navigate. Let’s explore the exciting world of crowdfunding and its impact on the startup ecosystem.

Importance of Crowdfunding for Startups

Crowdfunding plays a crucial role in supporting startup ventures by providing them with an alternative method to access capital and validate their ideas. Unlike traditional fundraising methods, crowdfunding allows startups to pitch their ideas to a larger audience and secure funding from multiple backers.

Access to Capital

- Crowdfunding enables startups to raise funds from a diverse group of investors, including individuals, angel investors, and venture capitalists.

- By leveraging online platforms, startups can reach a global audience and attract potential investors who are interested in their innovative solutions.

- Startups can set funding goals, offer rewards or equity in exchange for investments, and create a compelling pitch to attract backers.

Validation of Ideas

- Through crowdfunding campaigns, startups can gauge market interest in their products or services before fully launching them.

- Backers who contribute to crowdfunding campaigns validate the startup’s idea by showing interest and willingness to invest in the venture.

- Successful crowdfunding campaigns can serve as proof of concept and help startups attract additional funding from traditional investors.

Comparison with Traditional Fundraising

- Traditional fundraising methods, such as bank loans or venture capital, may involve lengthy approval processes and strict eligibility criteria.

- Crowdfunding offers startups a faster and more accessible way to raise capital without giving up equity or incurring debt.

- Startups can maintain greater control over their operations and decision-making by relying on crowdfunding for financing.

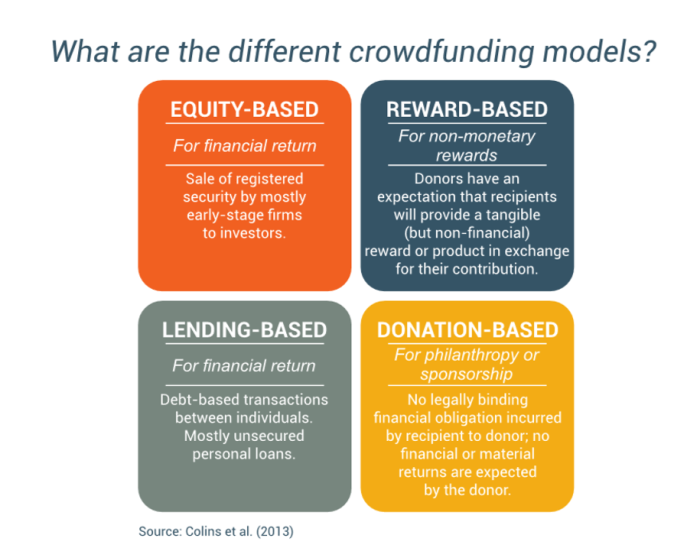

Types of Crowdfunding Models

Crowdfunding for startups can take various forms, each with its own set of advantages and disadvantages. Understanding the different types of crowdfunding models is crucial for startups looking to raise capital effectively.

Reward-Based Crowdfunding

Reward-based crowdfunding involves offering backers rewards or incentives in exchange for their financial support. These rewards can range from early access to products, exclusive merchandise, or personalized experiences.

- Pros:

Allows startups to engage with their customers and build a loyal community

Offers a tangible benefit to backers, increasing the likelihood of successful funding

- Cons:

May require significant time and resources to fulfill rewards

Limited to projects with attractive rewards for backers

Successful examples of startups using reward-based crowdfunding include Pebble Technology, which raised over $20 million on Kickstarter for its smartwatch.

Equity-Based Crowdfunding

Equity-based crowdfunding involves selling shares or equity stakes in the company to investors in exchange for funding. This model allows backers to become shareholders in the startup and share in its success.

- Pros:

Provides startups with access to a broader pool of investors

Backers have a vested interest in the success of the startup

- Cons:

Requires compliance with securities regulations

May result in loss of control and decision-making power for founders

An example of a successful startup that utilized equity-based crowdfunding is Oculus VR, which raised funds on Kickstarter before being acquired by Facebook for $2 billion.

Donation-Based Crowdfunding

Donation-based crowdfunding involves raising funds from individuals who believe in the startup’s mission or cause without expecting any financial returns. This model is commonly used for charitable or social impact projects.

- Pros:

Allows startups to raise funds for social causes or community projects

Potential for viral fundraising campaigns

- Cons:

Dependent on donors’ willingness to contribute without expecting rewards

Limited scalability for revenue generation

One notable example of a startup that thrived through donation-based crowdfunding is Charity: Water, which funds clean water projects in developing countries.

Tips for Running a Successful Crowdfunding Campaign

Running a successful crowdfunding campaign for startups requires careful planning and execution. Here are some key strategies to help you create a compelling campaign, set realistic funding goals, and promote it effectively:

Creating a Compelling Campaign

When creating your crowdfunding campaign, it’s essential to tell a compelling story that resonates with your target audience. Make sure to highlight the problem your startup is solving, the unique value proposition, and why people should support your project. Use engaging visuals, videos, and testimonials to capture the attention of potential backers.

When it comes to starting a business, one important aspect to consider is business credit for startups. Establishing good credit early on can help your business access financing and build credibility with suppliers and lenders.

Setting Realistic Funding Goals

Setting realistic funding goals is crucial for the success of your campaign. Be transparent about how the funds will be used and break down the budget to show backers where their money will go. Avoid setting overly ambitious goals that may be difficult to reach, as this can lead to disappointment and a failed campaign.

If you’re involved in a commercial truck accident, it’s crucial to seek legal help from a commercial truck accident lawyer. These specialized attorneys can navigate the complexities of trucking regulations and help you seek compensation for damages.

Promoting Your Campaign

After launching your crowdfunding campaign, it’s essential to promote it to reach a wider audience. Utilize social media, email marketing, and press releases to generate buzz around your project. Engage with your backers regularly, provide updates on the campaign’s progress, and offer incentives or rewards to encourage more people to support your startup.

Legal and Regulatory Considerations in Crowdfunding

When startups decide to engage in crowdfunding, they must be aware of the legal requirements and regulations that govern this fundraising method. These regulations are put in place to protect both the startups and investors involved in the crowdfunding campaign.

Equity-Based Crowdfunding Regulations, Crowdfunding for startups

Equity-based crowdfunding involves offering investors a share in the company in exchange for their financial support. Startups engaging in equity-based crowdfunding must comply with securities laws, which are designed to ensure transparency and investor protection. These laws may vary depending on the country or region where the campaign is conducted.

- Startups must provide accurate and detailed information about their business, financials, and risks associated with investing in their company.

- They must also ensure that only accredited investors, who meet certain income or net worth requirements, can participate in the campaign.

- Compliance with these regulations is crucial to avoid legal issues and protect investors’ interests.

Reward-Based Crowdfunding Regulations

Reward-based crowdfunding involves offering backers a reward or product in exchange for their financial support, rather than equity in the company. While reward-based crowdfunding is often seen as less complex than equity-based crowdfunding, startups still need to consider certain legal aspects.

- Startups must fulfill their promises to backers by delivering the rewards as described in the campaign.

- They should clearly Artikel the terms and conditions of the rewards to avoid any misunderstandings or disputes.

- Compliance with consumer protection laws is essential to maintain trust and credibility with backers.

Compliance and Investor Protection

Navigating compliance issues in crowdfunding can be challenging for startups, especially when dealing with different regulations across regions. To protect investors and ensure a successful campaign, startups can:

- Seek legal advice from experts specializing in crowdfunding regulations to ensure compliance.

- Be transparent and provide regular updates to investors throughout the campaign process.

- Implement proper risk management strategies to address any potential legal or financial risks.

Ultimate Conclusion: Crowdfunding For Startups

In conclusion, crowdfunding emerges as a powerful tool for startups, offering a gateway to financial support and market validation. By leveraging the diverse crowdfunding models, implementing effective strategies, and adhering to legal frameworks, startups can pave the way for growth and success in an increasingly competitive landscape. As the entrepreneurial journey continues, the potential of crowdfunding to drive innovation and fuel the dreams of aspiring business owners remains a compelling reality.