Commercial loans for startups are crucial in providing financial support for new businesses. From exploring different types of loans to understanding the application process, this topic delves into the essentials of securing funding for startup ventures.

As entrepreneurs navigate the complexities of commercial loans, knowing the eligibility criteria, factors influencing approval, and comparing traditional lenders with alternative options becomes paramount for making informed financial decisions.

Types of Commercial Loans for Startups

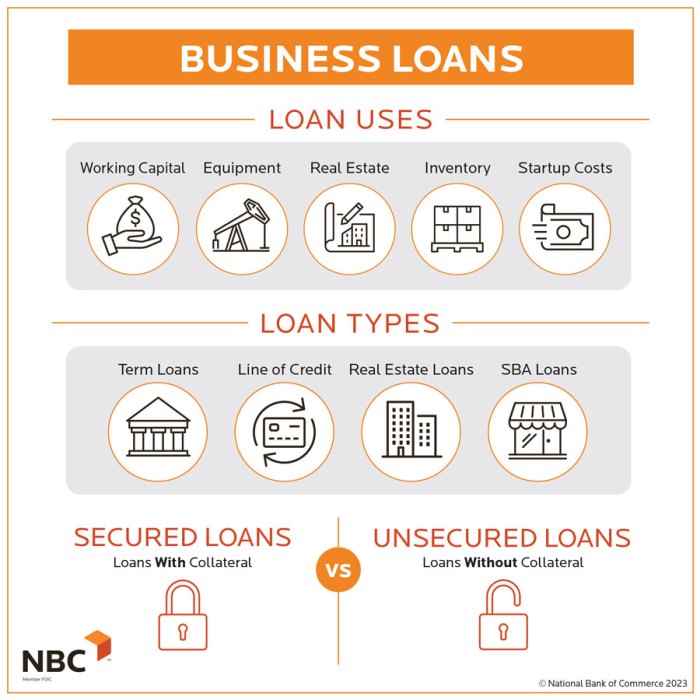

Starting a new business can be an exciting venture, but it often requires financial support to get off the ground. Commercial loans for startups are designed to provide the necessary funding for new businesses to grow and succeed. Here are some of the most common types of commercial loans available for startups:

1. SBA Loans

SBA loans are backed by the U.S. Small Business Administration and are a popular choice for startups due to their low interest rates and favorable terms. To be eligible for an SBA loan, startups must meet certain criteria, including having a solid business plan, good credit history, and the ability to repay the loan.

2. Business Lines of Credit

Business lines of credit are another common type of commercial loan for startups. This type of loan provides businesses with a revolving line of credit that can be used for various business expenses. Startups can benefit from the flexibility of a business line of credit, but they must have a good credit score and a strong financial history to qualify.

3. Equipment Financing

Startups that need to purchase equipment or machinery for their business operations can opt for equipment financing. This type of loan allows startups to spread the cost of expensive equipment over time, making it more manageable. To qualify for equipment financing, startups typically need to provide collateral in the form of the equipment being purchased.

4. Invoice Financing

Invoice financing is a type of commercial loan that allows startups to borrow money based on their accounts receivable. Startups can use their unpaid invoices as collateral to secure funding, which can help improve cash flow and keep the business running smoothly. Eligibility for invoice financing is usually based on the creditworthiness of the startup’s customers.

Each type of commercial loan for startups has its own advantages and disadvantages, so it’s important for new businesses to carefully consider their financial needs and goals before choosing the right loan option for them.

Application Process for Commercial Loans

When applying for a commercial loan as a startup, there are several key steps to keep in mind to increase your chances of success. It’s important to prepare a strong loan application and gather all the necessary documentation to present a compelling case to potential lenders.

Steps in Applying for a Commercial Loan

- Research Lenders: Start by researching different lenders and their specific requirements for commercial loans.

- Prepare a Business Plan: Develop a detailed business plan that Artikels your startup’s goals, financial projections, and how the loan will be utilized.

- Evaluate Loan Options: Consider different types of commercial loans available and choose the one that best fits your startup’s needs.

- Gather Documentation: Collect all necessary documentation, such as financial statements, tax returns, and legal documents, to support your loan application.

- Submit Application: Complete the loan application form and submit it along with all required documentation to the lender.

- Review Terms: Once your application is submitted, carefully review and negotiate the terms of the loan with the lender.

- Wait for Approval: The lender will review your application and conduct due diligence before making a decision on your loan application.

- Receive Funds: If approved, you will receive the funds from the commercial loan to use for your startup’s financing needs.

Tips for Preparing a Strong Loan Application for Startups

- Provide Accurate Financial Information: Ensure that your financial statements and projections are accurate and realistic to build credibility with lenders.

- Show Strong Business Potential: Highlight the potential for growth and profitability in your startup to demonstrate to lenders that you are a viable investment.

- Explain Loan Purpose: Clearly articulate how the loan funds will be used to support your startup’s operations and achieve key milestones.

- Maintain Good Credit: Maintain a good personal and business credit score to strengthen your loan application and improve your chances of approval.

- Seek Professional Advice: Consider working with financial advisors or consultants to help you navigate the loan application process and improve your chances of success.

Documentation Required During the Commercial Loan Application Process

- Business Plan: Detailed business plan outlining your startup’s objectives, strategies, and financial projections.

- Financial Statements: Recent financial statements, including balance sheets, income statements, and cash flow statements.

- Tax Returns: Personal and business tax returns for the past few years to demonstrate financial stability.

- Legal Documents: Any legal documents related to your startup, such as business licenses, registrations, and contracts.

- Credit History: Personal and business credit reports to assess your creditworthiness as a borrower.

Factors Influencing Approval of Commercial Loans: Commercial Loans For Startups

When applying for commercial loans for startups, several key factors play a significant role in determining whether the loan will be approved or not. Factors such as credit score, business plan, collateral, and financial projections can greatly influence the approval process.

Credit Score and Business Plan

Having a good credit score is crucial when applying for a commercial loan. Lenders use credit scores to evaluate the creditworthiness of the borrower and determine the risk involved in lending money. A higher credit score indicates a lower risk for the lender, making it more likely for the loan to be approved. In addition, a well-thought-out business plan that Artikels the startup’s goals, strategies, and financial projections can also positively impact the approval of a commercial loan.

Collateral and Financial Projections, Commercial loans for startups

Collateral serves as a form of security for the lender in case the borrower defaults on the loan. By providing collateral, startups can reduce the risk for the lender, making it easier to secure a commercial loan. Financial projections, including revenue forecasts, cash flow statements, and profit projections, help lenders assess the startup’s ability to repay the loan. Accurate and realistic financial projections can increase the chances of loan approval, as they demonstrate the startup’s financial stability and growth potential.

Comparison of Traditional Lenders and Alternative Lenders

Traditional lenders, such as banks, have long been the go-to option for commercial loans. However, alternative lenders, including online lenders and peer-to-peer platforms, have gained popularity in recent years for providing funding to startups. Let’s explore the differences between traditional lenders and alternative lenders for startup commercial loans.

Traditional Lenders (Banks)

Traditional lenders, like banks, have a reputation for offering stability and security when it comes to commercial loans. They generally have stricter eligibility criteria and require extensive documentation for approval. However, they usually offer lower interest rates and longer repayment terms compared to alternative lenders. Some examples of popular traditional lenders providing commercial loans for startups include Wells Fargo, JPMorgan Chase, and Bank of America.

Alternative Lenders (Online Lenders, Peer-to-Peer Platforms)

Alternative lenders, on the other hand, offer a more streamlined and flexible application process for commercial loans. They often cater to startups with less established credit histories and may approve loans quicker than traditional lenders. However, alternative lenders typically charge higher interest rates and have shorter repayment terms. Examples of popular alternative lenders offering commercial loans for startups include Kabbage, Funding Circle, and LendingClub.

Ultimate Conclusion

In conclusion, navigating the world of commercial loans for startups requires a strategic approach. By understanding the nuances of different loan options and the application process, entrepreneurs can make sound financial decisions to fuel the growth of their businesses.

When you find yourself in need of a motorcycle crash lawyer , it’s crucial to seek out a professional with experience in handling these specific types of cases. These lawyers are well-versed in the intricacies of motorcycle accidents and can provide you with the guidance and support you need during this challenging time.

If you’ve been involved in a major car accident, don’t hesitate to reach out to a major car accident lawyer for assistance. These legal experts specialize in dealing with complex car accident cases and can help you navigate the legal process to ensure you receive the compensation you deserve.