Business loans for new companies are crucial for startups looking to secure financial assistance. From understanding the various types of loans available to exploring strategies for effective loan management, this guide delves into the essentials of business financing.

Overview of Business Loans for New Companies

Business loans play a crucial role in providing financial support to new companies and startups. These loans are specifically designed to help businesses cover their initial expenses, invest in growth opportunities, and manage cash flow effectively.

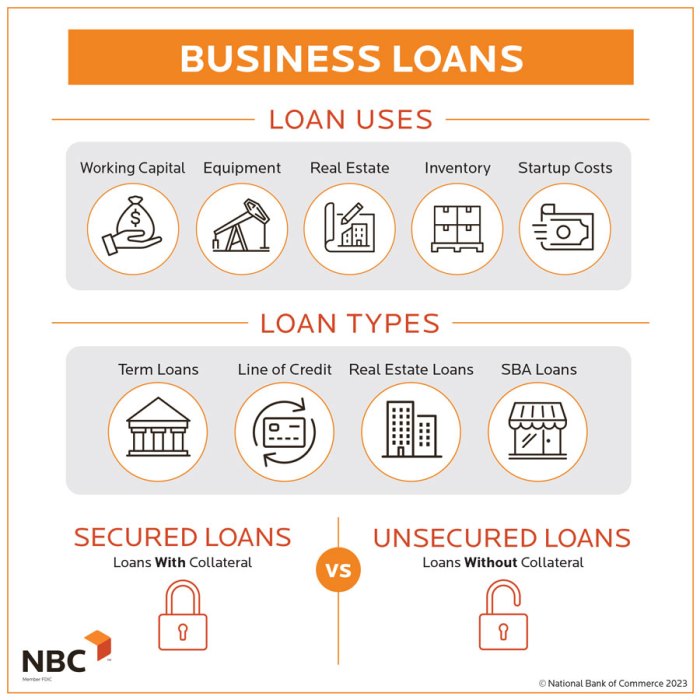

Types of Business Loans for New Companies

- Term Loans: These loans involve borrowing a lump sum amount which is repaid over a fixed term with regular payments.

- Business Lines of Credit: This type of loan provides businesses with a revolving line of credit that can be used when needed, similar to a credit card.

- SBA Loans: Small Business Administration loans are government-backed loans that offer favorable terms to qualifying businesses.

Importance of Business Loans for Startups

Business loans are essential for startups and new companies as they provide the necessary funding to cover initial expenses such as equipment purchases, marketing efforts, hiring employees, and other operational costs. Without access to these funds, many startups may struggle to get off the ground and grow their business effectively.

Eligibility Criteria for Business Loans

In order to qualify for a business loan, new companies need to meet certain eligibility criteria set by lenders. These criteria can vary depending on whether you are applying with a traditional lender like a bank or with an alternative lender such as an online lending platform.

Traditional Lenders vs Alternative Lenders

When it comes to traditional lenders like banks, the eligibility criteria are usually more stringent. They typically require:

– A high credit score (above 700)

– A detailed business plan

– Collateral to secure the loan

– Proof of business revenue and profitability

On the other hand, alternative lenders may have more flexible eligibility requirements, which can include:

– Lower credit score requirements

– Faster approval process

– Higher interest rates

– Shorter repayment terms

Credit Scores and Business Plans

Credit scores play a significant role in determining eligibility for a business loan. Lenders use credit scores to assess the creditworthiness of the borrower and the likelihood of repayment. A higher credit score increases the chances of approval and may qualify you for lower interest rates.

Having a well-developed business plan is also crucial for eligibility. Lenders want to see a detailed plan outlining your business goals, revenue projections, and repayment strategy. A solid business plan demonstrates to lenders that you have a clear vision for your company and a sound strategy for success.

Application Process for Business Loans

When applying for a business loan as a new company, it is essential to follow a step-by-step process and provide all the necessary documentation to improve your chances of approval.

Step-by-Step Process for Applying for a Business Loan

- Research and compare different lenders to find the best fit for your business needs.

- Prepare a detailed business plan outlining your company’s goals, financial projections, and how the loan will be used.

- Gather all required documentation, including financial statements, tax returns, and legal documents.

- Fill out the loan application form accurately and completely.

- Submit your application along with all supporting documents to the lender.

- Wait for the lender to review your application and make a decision.

Documentation and Information Required During the Application Process

- Business plan with financial projections

- Personal and business tax returns

- Bank statements

- Legal documents such as business licenses and registrations

- Credit history and score

Tips for Preparing a Strong Loan Application

- Ensure your business plan is detailed and well-structured.

- Provide accurate and up-to-date financial information.

- Improve your personal and business credit score before applying.

- Be prepared to explain how the loan will benefit your company and how you plan to repay it.

- Consider seeking professional help or advice to strengthen your application.

Securing Funding and Managing Business Loans

Securing funding for a new company can be a challenging task, especially when traditional business loans may not be easily accessible. However, there are alternative ways to secure funding and strategies to effectively manage business loans to ensure financial stability.

Exploring Alternative Funding Options

- Angel Investors: Angel investors are individuals who provide capital for a business start-up in exchange for ownership equity or convertible debt. They can be a great source of funding for new companies.

- Venture Capital: Venture capital firms invest in early-stage companies with high growth potential. Securing venture capital funding can provide the necessary resources for expansion.

- Crowdfunding: Crowdfunding platforms allow entrepreneurs to raise funds from a large number of individuals. This can be a viable option for new companies looking to finance their operations.

Strategies for Effective Loan Management

- Create a Detailed Budget: Develop a comprehensive budget that Artikels all expenses and revenue projections. This will help you track your financial performance and ensure you can meet loan obligations.

- Monitor Cash Flow: Regularly monitor your cash flow to ensure you have enough funds to cover loan payments. Implement strategies to improve cash flow if necessary.

- Communicate with Lenders: Maintain open communication with your lenders and update them on your business performance. In case of financial difficulties, discuss potential solutions with them proactively.

Challenges in Repaying Business Loans

- High Interest Rates: Business loans often come with high-interest rates, which can increase the overall cost of borrowing and put strain on company finances.

- Market Fluctuations: Economic downturns or market fluctuations can impact a new company’s ability to generate revenue, making it challenging to meet loan repayment deadlines.

- Lack of Collateral: Some lenders may require collateral to secure a business loan, which can be difficult for new companies to provide, limiting their borrowing options.

Final Conclusion: Business Loans For New Companies

As new companies navigate the world of business loans, it’s essential to stay informed about funding options and best practices for loan management. By implementing sound financial strategies, new businesses can pave the way for growth and success.

When you find yourself in a bicycle accident and need legal assistance, don’t hesitate to contact a bicycle accident injury lawyer for guidance. These professionals specialize in handling cases related to bicycle accidents and can help you navigate through the legal process.

If you’ve been involved in a bicycle crash and are seeking legal advice, consider reaching out to a bicycle crash lawyer for support. These lawyers have the expertise to assist you in understanding your rights and pursuing the compensation you deserve.