Business loan calculator for startups, a crucial tool for financial planning, allows new businesses to make informed decisions about loans. This paragraph aims to engage readers with valuable insights on how to effectively utilize this tool.

Exploring the key features, usage tips, and benefits of using a business loan calculator for startups will be covered in detail, providing a comprehensive understanding of its significance.

Introduction to Business Loan Calculator for Startups

When starting a new business, securing the right amount of funding is crucial for success. This is where a business loan calculator can be incredibly helpful for startups. By accurately estimating loan amounts, interest rates, and repayment terms, entrepreneurs can make informed financial decisions and plan effectively for their business growth.

When faced with a head injury due to an accident, it is crucial to seek the help of a head injury lawyer who specializes in such cases. These legal experts can provide the necessary guidance and support to ensure you receive the compensation you deserve.

How a Business Loan Calculator Works

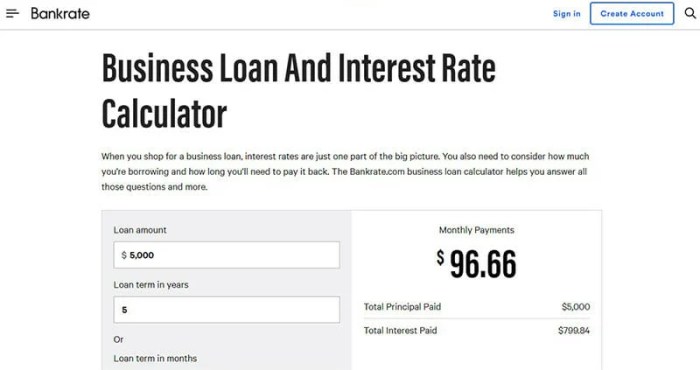

A business loan calculator is a tool that helps startups calculate their potential loan payments based on various parameters such as loan amount, interest rate, and repayment period. Users simply input these details into the calculator, and it generates an estimated monthly payment amount, total interest paid, and the overall cost of the loan. This information is essential for startups to understand their financial obligations and make informed borrowing decisions.

In the unfortunate event of an auto accident, it is important to consult with the best auto accident lawyer who can help you navigate through the legal process and fight for your rights. Their expertise can make a significant difference in the outcome of your case.

Benefits of Utilizing a Business Loan Calculator, Business loan calculator for startups

- Accurate Financial Planning: By using a business loan calculator, startups can accurately estimate their loan payments and total costs, allowing them to create realistic financial projections and budgets.

- Comparison of Loan Options: Entrepreneurs can input different loan scenarios into the calculator to compare interest rates, repayment terms, and total costs. This enables startups to choose the most cost-effective loan option for their business.

- Budget Management: Understanding the financial impact of a loan helps startups manage their cash flow effectively and avoid taking on more debt than they can afford. This leads to better financial stability and growth opportunities for the business.

Key Features of Business Loan Calculators: Business Loan Calculator For Startups

Business loan calculators are essential tools for startups and small businesses to estimate their loan payments and plan their finances effectively. These calculators typically include key features that help users make informed decisions when borrowing funds.

Factors Considered in Calculation

- Interest Rates: Business loan calculators take into account the interest rates offered by lenders. The interest rate significantly impacts the total cost of the loan and the monthly payments.

- Loan Amount: Users can input the desired loan amount to calculate the monthly payments and total interest paid over the loan term. This feature helps businesses determine the affordability of the loan.

- Loan Terms: The loan term, or the length of time over which the loan will be repaid, is another crucial factor in the calculation. Shorter loan terms typically result in higher monthly payments but lower overall interest costs.

Additional Tools and Functionalities

Business loan calculators may also offer the following advanced tools and functionalities:

- Amortization Schedule: Some calculators generate an amortization schedule that Artikels the payment schedule, including the principal and interest portions of each payment. This feature helps businesses track their loan repayment progress.

- Comparison Tools: Advanced calculators may allow users to compare multiple loan options side by side, considering factors like interest rates, loan amounts, and terms. This functionality helps businesses choose the most cost-effective loan option.

- Prepayment Calculations: Certain calculators enable users to input additional payments or make prepayments towards the loan. This feature helps businesses understand how extra payments can shorten the loan term and reduce interest costs.

How to Use a Business Loan Calculator

Using a business loan calculator effectively can help you make informed decisions when it comes to financing your startup. Here are the steps to effectively use a business loan calculator:

Inputting Accurate Data

- Start by entering the loan amount you are considering borrowing. This should be the total amount of money you need to fund your startup.

- Next, input the interest rate that the lender is offering for the loan. Make sure to use the annual interest rate to get accurate calculations.

- Then, enter the loan term, which is the duration over which you will be repaying the loan. This can typically range from a few months to several years.

Reviewing Calculated Results

- Once you have entered all the necessary data, the business loan calculator will provide you with the monthly payment amount, total interest paid, and total repayment amount.

- Review these calculated results carefully to understand the financial implications of taking out the loan. This information can help you determine if the loan is affordable for your startup.

- Interpret the data provided by the calculator to make informed decisions about whether the loan terms align with your startup’s financial goals and capabilities.

Benefits of Using a Business Loan Calculator for Startups

Using a business loan calculator can be incredibly beneficial for startups in multiple ways. It can help with financial planning, comparing different loan options and scenarios, as well as aiding in budgeting and forecasting for startup growth.

Financial Planning

One of the main benefits of using a business loan calculator for startups is the ability to effectively plan their finances. By inputting specific loan amounts, interest rates, and repayment terms, startups can get a clear picture of their financial obligations and create a structured plan to manage their funds efficiently.

Comparing Loan Options

Startups can use a business loan calculator to compare different loan options and scenarios. By adjusting variables such as loan amount, interest rates, and repayment terms, entrepreneurs can evaluate various loan offers and choose the one that best suits their financial needs and capabilities.

Budgeting and Forecasting

Utilizing a business loan calculator can also aid startups in budgeting and forecasting for future growth. By calculating potential loan payments and interest costs, entrepreneurs can better understand their financial projections and plan their budgets accordingly to ensure sustainable growth and profitability.

Outcome Summary

In conclusion, the Business loan calculator for startups serves as a valuable resource for new businesses, empowering them to make sound financial decisions and plan for sustainable growth. By utilizing this tool effectively, startups can navigate the complexities of loans with confidence and clarity.