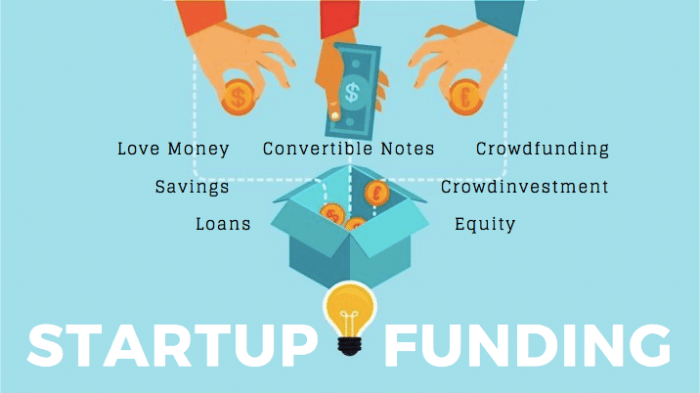

Financial assistance for startups opens doors to a world of funding opportunities, crucial for new ventures to thrive in a competitive market. Explore the diverse landscape of funding sources and strategies in this dynamic ecosystem.

From government grants to angel investors, venture capitalists, crowdfunding, and peer-to-peer lending, discover the key players shaping the financial landscape for startups.

Overview of Financial Assistance for Startups

Financial assistance for startups refers to the various forms of funding and support provided to new businesses to help them establish and grow. This assistance can come in the form of grants, loans, equity investments, mentorship, or other resources that help startups navigate the challenges of launching a new venture.

Financial assistance plays a crucial role in the startup ecosystem as it provides the necessary capital and support for entrepreneurs to turn their innovative ideas into viable businesses. Without adequate funding, many startups may struggle to survive and scale their operations, making financial assistance a key factor in the success of new ventures.

Common Sources of Financial Assistance for Startups

- 1. Angel Investors: Angel investors are individuals who provide capital in exchange for ownership equity or convertible debt. They often invest in early-stage startups and provide mentorship and guidance along with funding.

- 2. Venture Capital Firms: Venture capital firms invest in startups with high growth potential in exchange for equity. They typically focus on more established startups that have proven their business model and are ready to scale.

- 3. Small Business Administration (SBA) Loans: The SBA offers various loan programs designed to support small businesses, including startups. These loans can provide funding for working capital, equipment purchases, and other business needs.

- 4. Crowdfunding: Crowdfunding platforms allow startups to raise funds from a large number of individual investors or backers. This can be a great way for startups to validate their idea and raise capital without giving up equity.

- 5. Business Incubators and Accelerators: These programs provide startups with funding, mentorship, and resources in exchange for equity. They often offer structured programs to help startups grow and succeed in a competitive market.

Government Grants and Programs

Government grants and programs play a crucial role in providing financial assistance to startups. These initiatives can help businesses get off the ground and grow sustainably. Let’s explore the different government grants available for startups, the eligibility criteria to access them, and compare various government programs supporting startup financial assistance.

Different Government Grants Available for Startups

- Small Business Innovation Research (SBIR) Grants: These grants are offered by federal agencies to small businesses conducting research and development in various fields.

- Small Business Technology Transfer (STTR) Program: Similar to SBIR, this program aims to foster innovation and technological advancement in small businesses through federal funding.

- New Business Grant: Some states offer grants specifically for new businesses to help cover startup costs and initial expenses.

Eligibility Criteria for Startups to Access Government Grants

- Registered as a legal business entity

- Meet the definition of a small business based on annual revenue or number of employees

- Demonstrate a need for funding to support research, development, or growth

- Comply with specific requirements Artikeld by the granting agency or program

Comparison of Various Government Programs

| Program | Focus | Eligibility | Funding Amount |

|---|---|---|---|

| SBIR Grants | Research and development | Small businesses conducting R&D | Varies by agency, up to $1.75 million |

| STTR Program | Technology transfer and innovation | Small businesses collaborating with research institutions | Varies by agency, up to $1.75 million |

| New Business Grant | Startup costs and initial expenses | New businesses within specific states | Amount determined by state program |

Angel Investors and Venture Capitalists

Angel investors and venture capitalists play crucial roles in providing financial assistance to startups, enabling them to grow and succeed in the competitive business landscape.

When starting a new business, securing financing is crucial. One option to consider is commercial loans for startups , which can provide the necessary capital to launch and grow your venture. Another alternative worth exploring is short-term startup loans , which offer a quick injection of funds for immediate needs.

Both types of loans have their own benefits and considerations, so it’s essential to research and choose the best option for your business.

Angel Investors

Angel investors are individuals who invest their personal funds into early-stage startups in exchange for ownership equity or convertible debt. They typically provide smaller amounts of capital compared to venture capitalists and are often seasoned entrepreneurs or successful business professionals.

- Pros of seeking funding from angel investors:

- Flexible terms and personalized support: Angel investors can offer more flexible terms and hands-on guidance to startups due to their individual nature.

- Quick decision-making: Angel investors can often make investment decisions faster than venture capitalists, helping startups secure funding promptly.

- Cons of seeking funding from angel investors:

- Limited capital: Angel investors may not have as much capital to invest as venture capitalists, potentially restricting the growth opportunities for startups.

- Less formalized processes: Due to their informal nature, angel investors may lack the structured approach of venture capitalists, leading to potential challenges in governance and decision-making.

Venture Capitalists

Venture capitalists are professional investment firms that manage pooled funds from institutional investors to provide substantial capital to startups in exchange for equity ownership. They typically focus on scaling businesses rapidly and aim for high returns on investment.

When it comes to starting a new business, securing funding can be a crucial step. One option that many entrepreneurs consider is commercial loans for startups. These loans are specifically designed to help new businesses get off the ground and grow.

Another alternative to consider is short-term startup loans , which can provide quick access to the capital needed to launch a new venture.

- Pros of seeking funding from venture capitalists:

- Significant capital infusion: Venture capitalists can provide larger amounts of capital compared to angel investors, enabling startups to pursue aggressive growth strategies.

- Extensive networks and resources: Venture capitalists often have vast networks and industry connections that can help startups access valuable resources, partnerships, and strategic opportunities.

- Cons of seeking funding from venture capitalists:

- Rigorous due diligence: Venture capitalists conduct thorough due diligence processes before investing, which can be time-consuming and demanding for startups.

- Higher ownership stake: Venture capitalists typically require a more significant equity stake in startups, which can dilute the ownership of founders and limit their control over the company.

Crowdfunding and Peer-to-Peer Lending

Crowdfunding and peer-to-peer lending have emerged as popular alternatives for startups seeking financial assistance outside traditional sources.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of individuals, typically through online platforms. This method allows startups to access a diverse pool of investors who are willing to contribute varying amounts towards the business idea.

- Benefits:

- Access to a wider network of potential investors

- Validation of the business idea by gauging public interest

- Potential for building a community around the startup

- Challenges:

- Time-consuming to manage and promote the crowdfunding campaign

- Risk of not reaching the funding goal and losing momentum

- Legal complexities and regulations to navigate

Peer-to-Peer Lending, Financial assistance for startups

Peer-to-peer lending involves borrowing money directly from individuals or “peers” through online platforms that match borrowers with lenders.

- Benefits:

- Flexible loan terms and interest rates negotiated between parties

- Quick access to funds with less stringent requirements compared to traditional lenders

- Potential for establishing long-term relationships with lenders

- Challenges:

- Risk of default and potential damage to personal relationships with lenders

- Limited regulatory oversight compared to traditional financial institutions

- Interest rates may be higher for startups with less established credit history

End of Discussion: Financial Assistance For Startups

In conclusion, financial assistance for startups is a vital lifeline for budding entrepreneurs looking to turn their innovative ideas into successful businesses. By understanding the various funding options available, startups can navigate the complex financial terrain with confidence and determination.