Business startup financing sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

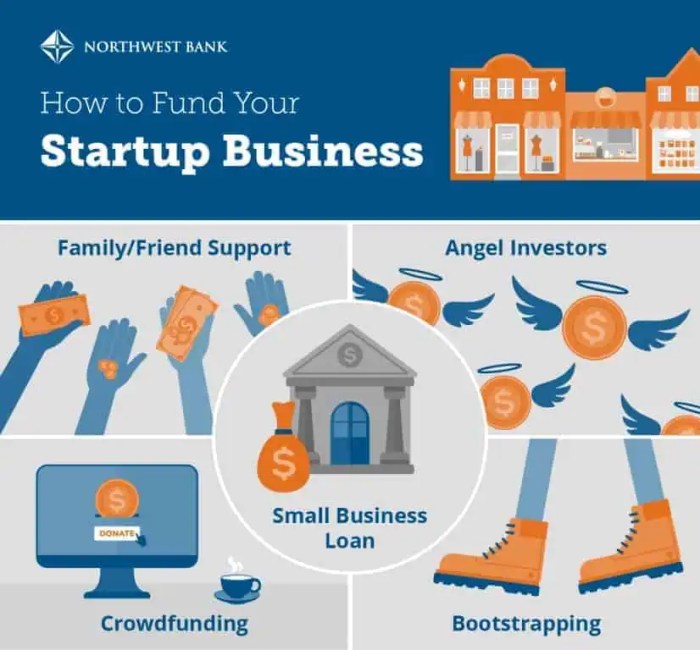

Starting a new business can be an exciting yet daunting journey, especially when it comes to securing the necessary funds to kickstart your venture. In this guide, we will explore the various financing options available to new startups, from traditional loans to alternative methods like crowdfunding.

Overview of Business Startup Financing

Starting a new business requires adequate funding to cover initial expenses and sustain operations until the business becomes profitable. Securing the right financing is crucial for the success of a startup.

Sources of Financing for Startups, Business startup financing

There are various sources of financing available to startups, each with its own advantages and considerations. These include:

- Personal Savings: Using personal savings is a common way for entrepreneurs to fund their startups. This demonstrates commitment and confidence in the business.

- Loans: Startups can obtain loans from banks, credit unions, or online lenders. This option provides a lump sum of money that must be repaid with interest.

- Investors: Angel investors and venture capitalists provide funding in exchange for equity in the company. This option can bring not only financial resources but also valuable expertise and connections.

- Crowdfunding: Platforms like Kickstarter and Indiegogo allow startups to raise funds from a large number of individuals in exchange for rewards or early access to products.

- Grants: Some startups may qualify for grants from government agencies, non-profit organizations, or corporations. These funds do not need to be repaid but often come with specific requirements.

Comparing Financing Options

It is essential for entrepreneurs to carefully consider the pros and cons of each financing option before making a decision. While loans may provide quick access to funds, they also come with the burden of repayment. On the other hand, investors can offer not only financial support but also guidance and mentorship. Crowdfunding can help validate the market demand for a product, while grants can provide non-dilutive funding for specific projects.

Bootstrapping as a Financing Strategy

Bootstrapping is a method of starting a business with minimal external capital, relying on personal savings, revenue reinvestment, and cost-cutting measures to fund operations. This approach is significant in startup financing as it allows entrepreneurs to maintain full control over their business without taking on debt or giving up equity to investors.

Examples of Successful Bootstrapped Businesses

- Basecamp: The project management software company was founded with just $10,000 and grew into a multi-million dollar business without any external funding.

- Mailchimp: The email marketing platform started as a side project and was bootstrapped by its founders, growing to become a leading player in the industry.

Advantages and Challenges of Bootstrapping

Bootstrapping offers the advantage of independence and full control over decision-making processes. It also encourages frugality and resourcefulness, leading to a lean and efficient operation. However, the challenges of bootstrapping include slower growth due to limited resources, potential burnout from wearing multiple hats, and reduced scalability compared to businesses with external funding.

In cases of head-on crashes, having a knowledgeable head-on crash lawyer on your side is essential. These attorneys specialize in handling the unique challenges presented by head-on collisions, working tirelessly to ensure that their clients receive the compensation they rightfully deserve.

Tips for Effective Bootstrapping

- Focus on generating revenue early on to sustain the business without external financing.

- Minimize overhead costs by working from home, outsourcing non-core functions, and negotiating favorable terms with suppliers.

- Prioritize customer feedback and iterate quickly to deliver value and generate positive word-of-mouth referrals.

- Leverage free or low-cost marketing channels such as social media, content marketing, and partnerships to reach a wider audience without a significant budget.

Securing Loans for Startup Capital

Securing the necessary capital through loans is a common practice for many startups looking to get off the ground. Understanding the process and criteria for obtaining a business loan is crucial for the success of your venture.

Types of Loans Available to New Businesses

- Term Loans: These are traditional loans with a fixed repayment term and interest rate.

- Lines of Credit: Flexible loans that allow you to borrow and repay funds as needed.

- SBA Loans: Government-backed loans with lower interest rates and longer repayment terms.

- Equipment Financing: Loans specifically for purchasing equipment needed for your business.

Criteria Lenders Consider When Evaluating Loan Applications

- Credit Score: A good credit score is essential for loan approval and favorable terms.

- Business Plan: Lenders will want to see a detailed business plan outlining your strategy for success.

- Cash Flow: Demonstrating a steady cash flow will increase your chances of loan approval.

- Collateral: Providing collateral can help secure a loan, especially for new businesses.

Tips on Improving Loan Eligibility and Securing Favorable Terms

- Work on Improving Your Credit Score: Pay off debts and ensure timely payments to boost your credit score.

- Pitch a Strong Business Plan: Highlight your market research, revenue projections, and growth strategy in your business plan.

- Show a Positive Cash Flow: Lenders want to see that your business is financially stable and capable of repaying the loan.

- Consider Collateral Options: Offering assets as collateral can help mitigate the risk for lenders and improve your chances of approval.

Attracting Investors for Funding

When it comes to startup financing, attracting investors plays a crucial role in providing the necessary capital for growth and development. Investors not only bring in funds but also expertise, network, and guidance to help the business succeed.

When facing the aftermath of a fatal motorcycle accident, it’s crucial to seek legal guidance from a skilled fatal motorcycle accident lawyer who understands the complexities of such cases. These professionals can provide the necessary support and expertise to navigate the legal process and seek justice for the victim and their loved ones.

Key Factors that Attract Investors

Investors are attracted to new businesses based on various factors:

- A strong and innovative business idea with a clear value proposition.

- A scalable business model with potential for high returns on investment.

- A competent and dedicated founding team with relevant experience and skills.

- A well-defined market opportunity and a solid plan for market penetration.

- A realistic financial projection and a clear exit strategy for investors to realize their returns.

Types of Investors and Investment Criteria

There are different types of investors that startups can approach for funding:

- Angel Investors: Individual investors who provide capital in exchange for equity ownership. They are typically high-net-worth individuals looking to invest in early-stage startups.

- Venture Capitalists: Professional investors who manage funds from institutions or wealthy individuals. They invest in startups with high growth potential in exchange for equity.

Investors evaluate startups based on criteria such as:

- The size of the market opportunity.

- The competitive advantage of the business.

- The strength of the founding team.

- The potential for scalability and profitability.

Pitching to Investors and Securing Funding

When pitching to investors, startups should focus on:

- Creating a compelling pitch deck that highlights the business opportunity, market potential, competitive advantage, and financial projections.

- Practicing the pitch to communicate the value proposition effectively and address potential investor concerns.

- Building a strong network and seeking introductions to investors through referrals or networking events.

- Negotiating terms that are fair and beneficial for both the startup and the investors.

Crowdfunding and Alternative Financing Options: Business Startup Financing

Crowdfunding is a method of raising capital through the collective effort of a large number of individuals, typically via online platforms. This alternative financing option allows startups to pitch their business ideas to a wide audience and attract small investments from many people.

Crowdfunding for Startups

- Crowdfunding provides access to a larger pool of potential investors who may be interested in supporting innovative ideas.

- It allows startups to validate their business concept and gain market feedback before fully launching their products or services.

- Startups can create buzz and generate publicity for their business through crowdfunding campaigns.

Benefits and Challenges of Crowdfunding

- Benefits:

- Access to capital without giving up equity or taking on debt.

- Potential for rapid fundraising and quick access to funds.

- Opportunity to build a community of supporters and early adopters.

- Challenges:

- High competition on crowdfunding platforms may make it challenging to stand out.

- Failure to reach funding goals means no access to capital.

- Time-consuming to manage and promote a crowdfunding campaign effectively.

Alternative Financing Options

- Grants: Non-repayable funds provided by governments, corporations, or foundations to support startups in specific industries or sectors.

- Competitions: Startup competitions offer cash prizes, mentorship, and networking opportunities to early-stage businesses with promising ideas.

- Incubators: Organizations that offer workspace, resources, and mentorship to startups in exchange for equity or fees.

Success Stories

One notable success story is the Pebble smartwatch, which raised over $10 million through a crowdfunding campaign on Kickstarter, becoming one of the most funded projects on the platform.

Another example is Oculus VR, a virtual reality company that started with a successful crowdfunding campaign before being acquired by Facebook for $2 billion.

Conclusion

As we wrap up our discussion on business startup financing, remember that adequate funding is crucial for the success of any new business. Whether you choose to bootstrap, secure a loan, attract investors, or explore alternative financing options, careful planning and strategic decision-making will be key to turning your entrepreneurial dreams into reality.